Let’s talk CPA career paths. Whether interested in forensic accounting, strategic management, or sustainability, the CPA credential paves the way.

But how high is the demand for CPAs and accountants?

According to CPA stats from the Bureau of Labor Statistics, CPAs will continue to be vital for navigating financial complexities, with a steady 4% growth of accounting and auditing roles expected through 2032.

This means that many CPA career paths exist for those looking for opportunities in the field.

Let’s explore some of my favorites.

Key Takeaways

- Diverse Opportunities: The CPA designation opens doors to a wide range of CPA career paths in accounting and finance, including roles in public accounting, corporate accounting, and specialized fields such as forensic accounting and sustainability.

- Steady Demand: With a projected 4% growth from now until 2032, CPAs remain essential for navigating financial complexities, ensuring the profession’s vitality and relevance.

- Emphasis on Specialization: The evolving business landscape is creating a demand for CPAs with specialized skills in areas like forensic accounting, management accounting, and information technology auditing, highlighting the importance of continuing education and certifications beyond the CPA.

- Global Opportunities: The CPA credential offers potential for international career paths, with reciprocity agreements and global demand for accounting expertise, underscoring the profession’s wide-reaching impact and opportunities for mobility.

The CPA designation is more than a title; it’s a passport to a wide array of CPA career paths in the field of accounting after you pass the CPA exam with a top prep course that you can continue using throughout your career. Whether you’re drawn to the bustling environment of public accounting firms or the strategic financial management roles within corporate sectors, exciting job opportunities exist.

As one Reddit User put it on an accounting thread: “There’s one major benefit to this career that’s often ignored: Leverage.”

I, too, pursued a career that was much different than I originally planned as a new CPA. In this guide, I’ll walk you through some options, highlighting key paths and the unique opportunities each presents.

Public Accounting: The Heartbeat of the CPA Career

Public accounting is the backbone of the CPA profession. A public accounting firm offers services that range from auditing financial statements to strategic tax planning and financial advisory. Exposure to various industries and clients in this sector provides a robust foundation for any CPA’s career.

- Public Accounting Firms: These are the powerhouses of the accounting world, where CPAs engage in auditing, tax, and consulting work. The Big Four accounting firms are renowned for their global presence and vast array of accounting services.

- Auditing Financial Statements: Auditing plays a critical role for CPAs, as it involves examining an organization’s financial records to make sure that they are accurate and compliant.

- Tax Planning and Compliance: CPAs offer expertise in navigating the complex tax landscape, ensuring that both individuals and corporations minimize their tax liabilities while complying with laws.

Public Accounting Salaries

All salary data is provided by Payscale and Glassdoor.

- Entry-Level Auditor/Accountant: Typically starts from $55,000 to $70,000 annually.

- Senior Auditor/Accountant: Salaries range from $70,000 to $90,000 annually.

- Manager: Salaries can range from $90,000 to $120,000 annually.

Corporate Accounting: Beyond the Numbers

Corporate accounting offers CPAs a chance to dive deep into the financial workings of specific industries, contributing to strategic financial planning, internal auditing, and financial reporting. This career path in accounting focuses on the management of internal financial processes and strategic decision-making.

- Financial Management: CPAs play a vital role in shaping their organizations’ financial strategy and operations, overseeing financial performance, and ensuring efficient resource use.

- Internal Auditing: A key component of risk management, internal auditors assess the effectiveness of an organization’s internal controls and risk mitigation strategies.

- Financial Reporting and Analysis: CPAs in this area prepare financial reports that accurately represent an organization’s financial position and performance, which is crucial for stakeholders’ decision-making.

Corporate Accounting Salaries

- Staff Accountant: Salaries usually start from $50,000 to $65,000 annually.

- Senior Accountant: Salaries can range from $65,000 to $85,000 annually.

- Accounting Manager: Salaries range from $80,000 to $110,000 annually.

- Chief Financial Officer (CFO): Can vary significantly, from $120,000 to $250,000+ annually, depending on the company size.

“The biggest upside of a CPA’s career is how long you can go without being without a job as you age. Lots of careers where you start having issues with losing your job and having a hard time replacing the income as you age. But being a CPA is one of those where age doesn’t impact that much as you don’t have physical wear and tear on your body. It’s harder to replace a CPA grey hair than someone in marketing or sales or operations or any other department. In a word, it’s longevity.”

Reddit User

Government and Nonprofit Accounting: Serving the Public Interest

Government accounting and nonprofit financial management offer unique avenues for those drawn to serve the public or contribute to the nonprofit sector. CPAs in these fields ensure accountability and efficient resource use, fulfilling a crucial role in maintaining public trust.

- Government Accounting: From federal government agencies to the general accounting office, CPAs ensure public funds are managed and allocated according to laws and regulations.

- Nonprofit Financial Management: CPAs help nonprofit organizations manage their finances, ensuring that donations and grants are used effectively toward their missions.

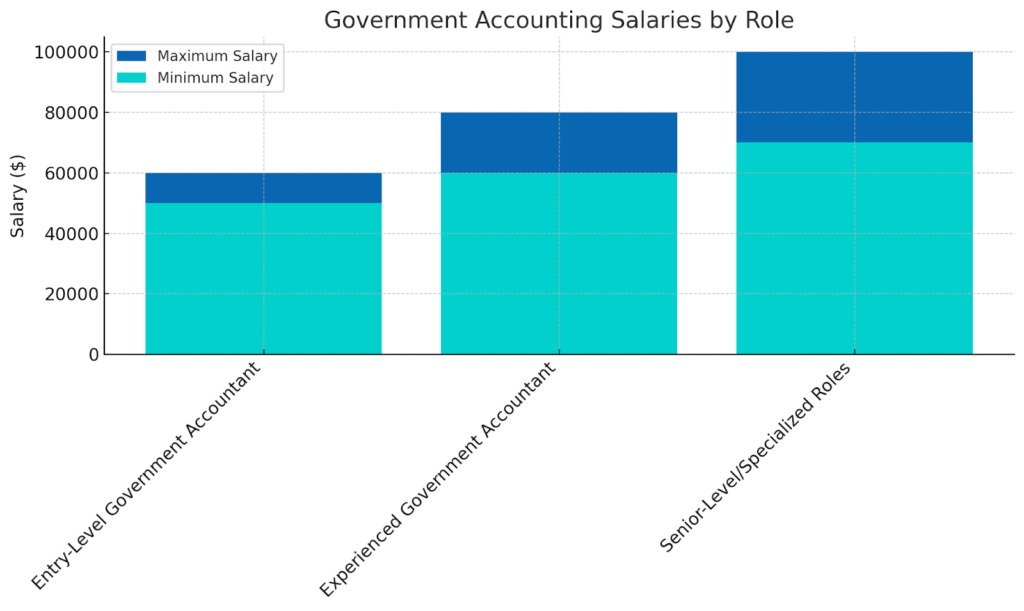

Government Accounting Salaries

- Entry-Level Government Accountant: Starts from $50,000 to $60,000 annually.

- Experienced Government Accountant: Can range from $60,000 to $80,000 annually.

- Senior-Level or Specialized Roles (e.g., Auditor for a Federal Agency): Salaries range from $70,000 to $100,000+ annually.

Education and Research: Shaping the Next Generation

For CPAs who are drawn to academia and the pursuit of knowledge, the fields of education and research provide a platform to influence future accountants and engage in cutting-edge studies that push the boundaries of accounting practices.

- Accounting Professors: At the heart of accounting education, professors not only teach courses ranging from basic accounting principles to advanced financial accounting but also mentor the next generation of accountants. Their role extends beyond the classroom, as they often engage in research, contributing new insights to the profession.

- Research Analysts: These professionals specialize in examining various facets of the accounting world, including trends in financial management, the impact of regulatory changes, and the evolution of accounting technologies. Their work informs both academic discourse and practical application in accounting practices.

Accounting Professor Salaries

- Entry-Level: Salaries typically start around $60,000 to $75,000 annually for those new to academia.

- Experienced: With more experience or tenure, salaries can range from $75,000 to $100,000+ annually.

- Senior-Level or Specialized Roles: Salaries for those in senior positions or with significant contributions to research can exceed $100,000 annually.

Accounting Research Analyst Salaries

- Entry-Level: Starting salaries usually range from $50,000 to $65,000 annually.

- Experienced: Salaries for those with more experience or specialization in accounting research can range from $65,000 to $85,000 annually.

- Senior-Level or Specialized Roles: Highly experienced analysts or those with niche expertise can see salaries ranging from $85,000 to $120,000+ annually.

Specialized Roles in Accounting: Niche Expertise

The accounting profession also offers paths that require specialized knowledge and skills, such as forensic accounting, financial analysis, and tax representation. These roles often demand a deep understanding of specific accounting areas, providing services critical to legal processes, financial strategy, and regulatory compliance.

- Forensic Accountants: Specialists in investigating financial fraud and disputes, forensic accountants combine their accounting knowledge with investigative skills to uncover truths hidden within financial data.

- Financial Analysts: These professionals analyze financial data to guide investment decisions, evaluate financial strategies, and assess organizations’ financial health. While CPAs can work in financial analysis, CFA certification is also relevant for this role due to its focus on investment and financial strategy.

Forensic Accountant Salaries

- Entry-Level: Salaries for newcomers to the field typically range from $55,000 to $70,000 annually.

- Experienced: With experience, forensic accountants can earn between $70,000 and $90,000 annually.

- Senior-Level or Specialized Roles: Salaries for senior positions or those with highly specialized skills can exceed $90,000 to $120,000+ annually.

Financial Analyst Salaries

- Entry-Level: Starting salaries for financial analysts are generally between $55,000 and $70,000 annually.

- Experienced: More experienced analysts can expect salaries ranging from $70,000 to $90,000 annually.

- Senior-Level or Specialized Roles: Financial analysts can earn from $90,000 to $120,000+ annually at the senior level or with significant expertise.

Continuing Your CPA Career Path

As Certified Public Accountants contemplate the progression of their careers, numerous pathways unfold that not only leverage their existing expertise but also offer avenues for specialization and advancement. Below are career roles that represent both a continuation and an evolution of the CPA career path, each with its unique focus and set of opportunities.

- Chief Financial Officer (CFO): This position oversees a company’s financial operations, focusing on strategy, reporting, and risk management. It is suitable for experienced CPAs aiming for executive positions.

- IT Auditors: These specialists evaluate and improve the controls around an organization’s IT systems. They are perfect for CPAs fascinated by technology and cybersecurity.

- International Tax Specialist: This position advises on tax issues for multinational operations. It is ideal for CPAs with an interest in global business and tax law diversity.

- Enrolled Agent (EA): This type of agent specializes in tax preparation and representation before the Internal Revenue Service (IRS). An enrolled agent with a CPA is great for someone with a deep focus on tax issues and client advocacy.

- Certified Internal Auditor (CIA): This designation focuses on internal controls and risk management within organizations. It is best for CPAs who excel in operational efficiency and compliance.

- Certified Management Accountants (CMA): This field focuses on financial planning, analysis, and strategic management. It is ideal for a CPA or CMA looking to enter financial management within corporations.

The Future of CPA Careers

As we look ahead, the CPA career path is poised for transformation, influenced by a blend of emerging trends, technological advancements, and a shift toward specialization. These changes offer both career opportunities and challenges for those holding or pursuing a CPA license, reshaping the accounting career landscape in profound ways.

Take $1,600 Off UWorld CPA Elite-Unlimited Course

Emerging Trends

The accounting profession is continuously evolving, with new trends emerging that significantly impact CPA career paths. The demand for services beyond traditional accounting, such as consulting on digital assets and sustainability reporting, is growing among these. This expansion broadens the scope of opportunities for CPAs, inviting them to apply their expertise in new and innovative ways.

Technology’s Impact

Technological advancements are changing every aspect of the accounting career, from how financial data is collected and analyzed to how public accounting firms interact with their clients. Automation and artificial intelligence are helping to streamline routine tasks, allowing CPAs to focus on higher-level analysis and advisory roles. Understanding and leveraging technology is becoming increasingly important in maintaining a competitive edge in accounting.

The Growing Need for Specialization

As the business world becomes more and more complex, there is a growing demand for CPAs with specialized skills. Areas such as forensic accounting, information technology auditing, and management accounting offer niche opportunities for those looking to differentiate themselves. Specialization enhances a CPA’s value to employers and clients and paves the way for a more focused and fulfilling accounting career.

Here’s a list of career path options per an accountant who took a unique path:

I took the accounting data engineer/data science career path because:

- I enjoy it a lot more than traditional accounting

- It pays WAY better

- The culture is usually WAY better

To answer your question of other career paths than public audit/tax at the top of my head:

- Technical Accounting, Internal Audit, and Forensic Accounting

- Management Accounting, Government Accounting, and Government Auditing

- Non-Profit Accounting, Financial Analysis, and Financial Planning

- Corporate Finance, Management Consulting, Academia, and Data Analysis

- IT Auditing, Portfolio Managing, Equity Research Analysis, Real Estate

- Valuation Analysis, Actuary, and Entrepreneurship

Advancing Your CPA Career

The path to advancing a CPA career is multifaceted and involves continuous learning, professional development, and networking. CPAs committed to growth and excellence will find numerous avenues to enhance their skills and expand their professional horizons.

Continuing Education

Continuing education is essential for CPAs to keep up with the rapid changes in accounting standards, tax laws, and business practices. Many choose to further their knowledge through advanced degrees or specialized accounting courses, ensuring they remain at the forefront of the profession.

Certifications Beyond the CPA

Pursuing additional certifications can significantly enhance a CPA’s career prospects. Certifications in areas like risk management, internal auditing, and financial planning provide CPAs with the tools to offer a broader range of accounting services and take on leadership roles within their organizations or private accounting practices.

Networking and Professional Organizations

Engagement with professional organizations and participation in networking events are invaluable for CPAs looking to advance their careers. These platforms offer CPAs the opportunity to connect with peers, exchange knowledge, and stay informed about accounting industry trends and job openings.

The Global Landscape of CPA Careers

The CPA designation opens doors to international career opportunities, reflecting the global nature of business and finance today. Understanding and navigating the global landscape is crucial for CPAs aiming to make their mark on the world stage.

Opportunities Abroad

The demand for accounting expertise is not limited by geography, with opportunities for CPAs to work abroad or with multinational corporations. Exposure to international accounting standards and practices enriches a CPA’s professional experience and enhances their versatility as a financial expert.

CPA Reciprocity Agreements

Reciprocity agreements between various countries allow CPAs to practice outside their home jurisdiction, provided they meet certain requirements. These agreements facilitate global mobility for CPAs, enabling them to pursue career opportunities worldwide.

Life as a CPA

The life of a CPA encompasses a blend of professional challenges and rewards, with work-life balance and job satisfaction being key components of a successful career.

Work-Life Balance

Achieving work-life balance is a priority for many CPAs, especially those working in high-pressure environments like public accounting firms. Flexible working arrangements and a focus on efficiency can help CPAs manage their professional and personal responsibilities effectively.

Job Satisfaction

Many CPAs find great satisfaction in their work, whether it’s through solving complex financial problems, helping businesses grow, or contributing to public trust in the financial system. The diversity of career paths available ensures that CPAs can find roles that align with their interests and values.

Challenges Facing CPAs

CPAs face a number of challenges in their careers, including keeping up with regulatory changes and maintaining ethical standards in a rapidly evolving business environment.

Keeping Up with Regulation Changes

Accounting is heavily regulated, and CPAs must stay informed about changes in laws, standards, and practices. This requires a commitment to ongoing education and adaptability to ensure compliance and protect the interests of clients and the public.

Ethical Considerations

Ethics lie at the heart of the CPA profession, with CPAs expected to uphold the highest standards of integrity and professionalism. Navigating ethical dilemmas and ensuring transparency in financial reporting is critical to maintaining trust in accounting.

Conclusion

The CPA career path offers a dynamic and rewarding journey filled with professional growth and development opportunities. By embracing change, pursuing specialization, and adhering to ethical standards, CPAs can navigate the challenges and capitalize on the opportunities in the evolving accounting world.

FAQs

A CPA license offers careers in tax consultancy, forensic accounting, executive roles like CFO, and specialized auditing, covering sectors from public practice to governmental accounting.

The CPA job market is strong and driven by the ongoing demand for financial expertise, ensuring that its role remains vital across various economic conditions.

CPAs can pursue global careers, focusing on certification reciprocity, learning International Financial Reporting Standards (IFRS), and understanding international tax laws.

CPAs can advance by mastering new technologies, earning dual certifications or degrees, specializing in niche areas, and engaging in industry networking.

CPAs enhance nonprofit and public sectors by ensuring financial transparency, advising on fiscal policy, and managing regulatory compliance.