Pursuing the coveted Certified Public Accountant (CPA) credential isn’t just a career choice; it’s a monumental challenge. Globally recognized, it signifies mastery of accounting principles, unwavering ethical standards, and the ability to deliver top-tier financial reporting.

It requires passing the CPA exam.

Administered by the American Institute of Certified Public Accountants (AICPA), the CPA examination stands as a test of knowledge and practical skills designed to mold elite accounting professionals. In a world of ever-evolving financial practices, the CPA exam is undergoing a revolution of its own, redefining the benchmark for excellence.

As the accounting landscape evolves, so does the CPA exam. The CPA Evolution introduced significant changes in 2024, making a thorough understanding of the exam’s structure and content even more important.

This article aims to share what CPA candidates can expect and how this credential paves the way for a successful career in accounting and finance.

Key Takeaways

- CPA Exam Core Sections: The CPA exam consists of three core sections – Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Regulation (REG).

- 2024 CPA Evolution: The CPA exam underwent significant changes in 2024 under the CPA Evolution initiative, including the removal of the BEC section and the introduction of specialized discipline sections.

- Eligibility Requirements: To sit for the CPA exam, candidates typically need a bachelor’s degree, 150 credit hours of coursework, 1-2 years of supervised work experience, and they must meet age and residency requirements specific to their state.

- Exam Format: The CPA exam is computer-based and comprises multiple-choice questions and task-based simulations, testing both theoretical knowledge and practical skills.

- Cost and Scheduling: The cost of the CPA exam varies by state, and candidates can schedule exams during four testing windows throughout the year, with recommended early scheduling due to limited slots.

Who Should Take the Uniform CPA Exam?

The CPA exam is designed for individuals who aspire to become leaders in accounting and finance. It is ideal for:

- Aspiring Public Accountants: Anyone aiming to practice public accounting, particularly in roles that require a deep understanding of auditing, taxation, and financial reporting.

- Accounting Graduates: Those who have completed a bachelor’s degree in accounting or a related field and are looking to advance their career in accounting.

- Finance Professionals: Individuals working in finance who seek to enhance their professional credentials and expertise in accounting practices.

- Business Professionals: Those in business roles who wish to gain a comprehensive understanding of financial principles to better manage their business’s financial aspects.

- International Accountants: Accountants from outside the United States who want to practice in the U.S. or expand their knowledge of U.S. accounting standards and practices.

- Students with a 150-Credit Hour Requirement: Students who have met or are planning to meet the 150-credit hour educational requirement, which is a common prerequisite for CPA licensure in many states.

CPA Exam Pass Rates

The pass rates for the CPA exam offer valuable insights into the exam’s rigor and the preparedness of candidates. Historically, these rates have varied across the different sections, reflecting the unique challenges and complexities of each part of the exam.

According to the National Association of State Boards of Accountancy (NASBA), historical pass rates hover around 45–55%, indicating a highly challenging assessment that requires thorough preparation and a deep understanding of accounting principles and practices. Your chances of passing significantly increase when studying with one of the top CPA review courses.

CPA Exam Eligibility and Requirements

The eligibility criteria for the CPA exam are comprehensive, ensuring that only those with a solid foundation in accounting principles and practices can sit for the exam.

The requirements typically include:

Eligibility Requirements for the CPA Exam

The CPA exam has specific eligibility criteria to ensure that candidates possess the foundational knowledge and skills necessary for the accounting profession. These requirements encompass educational background, work experience, and certain age and residency stipulations.

It’s important to note that every state has individualized standards, so the information below is just a starting place.

Educational Background

- Bachelor’s Degree: A bachelor’s degree in accounting or a related field is typically required.

- Credit Hours: Most states require 150 semester hours of college coursework, which may extend beyond a standard four-year degree.

Work Experience

- Supervised Experience: Candidates are usually required to complete 1-2 years of work experience under a licensed CPA. This experience should be in areas like accounting, auditing, or taxation to ensure practical exposure to key aspects of the profession.

Age and Residency Requirements

- Minimum Age: The minimum age for CPA exam eligibility is generally 18 years. However, some states require candidates to be 21, while others have no age requirement at all.

- Residency: Many states require candidates to be residents, have an office, or be employed within the state. This requirement varies, with some states offering flexibility for non-residents.

Additional Considerations

- Ethics Exam or Course: An ethics exam or course is often required, emphasizing the profession’s focus on ethical standards. However, this does not apply to all states.

- Background Check: Some states conduct background checks to verify the candidate’s integrity and professional conduct.

CPA Exam Sections

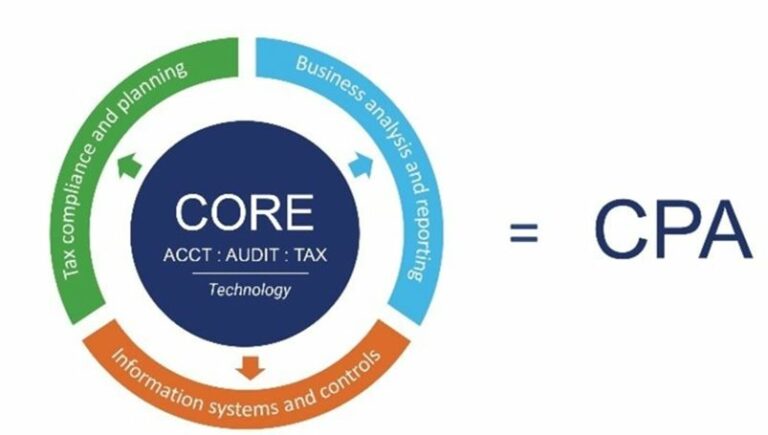

The CPA exam is structured into distinct sections, each designed to test critical areas of accounting knowledge and practice. Comprising several core and discipline sections, the exam’s format is tailored to evaluate the diverse competencies required in the modern accounting landscape.

Core Sections

The Core Sections of the CPA exam include:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

Each section targets a specific area of expertise, from the intricacies of auditing processes and ethical considerations in AUD to the comprehensive coverage of accounting principles in FAR and the detailed exploration of taxation and business law in REG.

BEC Removal

The removal of the Business Environment and Concepts (BEC) section from the CPA exam is a significant change, reflecting the evolving landscape of the accounting profession and the need to align the exam more closely with current industry demands. This was driven by a comprehensive review of the CPA role, which indicated a need for a deeper focus on areas like technology and data analytics.

Auditing and Attestation (AUD)

This section is pivotal for understanding the auditing process and the responsibilities of auditors. It encompasses a range of topics that are crucial for ensuring the accuracy and reliability of financial information.

- Ethics and Professional Responsibilities: Candidates are tested on their understanding of ethical practices in auditing, including independence and objectivity. This involves scenarios where ethical dilemmas are presented, and candidates must choose the most appropriate course of action.

- Risk Assessment and Response: This includes evaluating the risk of material misstatements in a company’s financial reports. Candidates might encounter scenarios where they need to design an audit plan based on their risk assessment.

- Audit Procedures and Evidence: This involves understanding different types of audit evidence and the methods of obtaining and evaluating them. For example, candidates might be asked to determine the best approach to auditing a company’s inventory or to evaluate the sufficiency of audit evidence provided for a particular financial statement assertion.

The revised CPA Exam integrates essential BEC topics into the AUD section, including basic economic concepts like supply and demand, as well as business processes and internal controls, to better align with the real-world scope of auditing in business contexts.

Financial Accounting and Reporting (FAR)

FAR tests a wide range of accounting knowledge, from basic principles to complex financial reporting.

- Financial Statements and Transactions: This includes the preparation and analysis of financial statements, understanding transactions like mergers and acquisitions, and dealing with foreign currency transactions.

- Governmental and Non-Profit Accounting: Candidates learn the nuances of accounting practices specific to governmental and non-profit organizations, which follow different standards than for-profit entities.

FAR Restructuring

The CPA Exam’s Business Analysis and Reporting (BAR) discipline now includes several advanced financial topics that were previously included in FAR.

Key topics redistributed to BAR include:

- Intangible Assets and Revenue Recognition: Covers indefinite-lived intangible assets (e.g., goodwill) and analysis-level tasks for revenue recognition.

- Stock Compensation and Financial Consolidation: Includes stock compensation (share-based payments), business combinations, consolidated financial statements, and derivatives/hedge accounting.

- Leases and Public Company Reporting: Examines lease accounting, sale-leaseback transactions, and reporting requirements for public companies, including S-X and S-K standards, XBRL, and segment disclosures.

- Governmental Accounting: Emphasizes comprehensive financial report formatting, government-wide financial statements, and typical transactions/events specific to government entities.

This restructuring aims to prepare candidates with specialized skills in financial analysis and reporting.

Regulation (REG)

This section covers federal taxation, business law, and the ethical and professional responsibilities of CPAs.

- Federal Taxation: This includes tax laws and regulations for individuals, corporations, and estates. Candidates might face questions on tax planning and compliance and the implications of different tax choices.

- Business Law: Understanding the legal aspects of business operations is crucial. This could involve questions on contracts, legal implications of business transactions, and the Uniform Commercial Code.

- Professional and Legal Responsibilities: This area tests the candidate’s understanding of the legal and professional standards a CPA must adhere to.

REG Restructuring

The CPA Exam’s Tax Compliance and Planning (TCP) discipline now consolidates advanced tax topics that were previously part of the Regulation (REG) section. This shift brings together complex individual and entity tax compliance, personal financial planning, and estate and gift taxation into one focused discipline. By centralizing these areas in TCP, the exam better aligns with the specialized knowledge needed for tax advisory roles, emphasizing strategic planning and compliance skills for both personal and business tax contexts.

Discipline Sections

The Discipline Sections of the CPA exam are comprised of:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

Each of these caters to the specialized needs of various accounting roles. These sections are meticulously crafted to provide candidates with the expertise required in distinct yet critical areas of the accounting profession:

Business Analysis and Reporting (BAR)

The BAR discipline focuses on financial statement analysis and corporate financial strategies, while also encompassing advanced technical accounting topics migrated from FAR. This section now includes:

- Revenue Recognition and Consolidations: Covers revenue recognition, business combinations, and consolidated financial statements.

- Advanced Accounting Topics: Derivatives and hedge accounting, lease accounting (including sale-leaseback and lessor accounting), and stock compensation.

- Public Company Reporting and Standards: Addresses XBRL, segment disclosures, and public company reporting requirements under S-X and S-K.

- Governmental Accounting: Emphasizes the format and content of comprehensive financial reports, including government-wide financial statements and reconciliation statements for governmental entities.

This expanded scope provides candidates with specialized expertise in complex reporting, advanced accounting standards, and governmental accounting principles, all essential for roles in financial management and analysis.

Information Systems and Controls (ISC)

ISC encompasses IT governance, data management, and cybersecurity controls, with ISC covering essential topics in IT governance, data management, and cybersecurity controls, with an added focus on advanced technology applications in accounting. Key areas now include:

- System and Organization Controls (SOC) Engagements: An in-depth understanding of SOC 1®, SOC 2®, and SOC 3® engagements is crucial for IT audits.

- Data Analytics in Auditing and Controls: Emphasizes data analytics techniques used in assessing data integrity, system vulnerabilities, and compliance with privacy standards.

These additions ensure that ISC prepares candidates to meet modern IT and cybersecurity challenges in the accounting profession, particularly in roles involving data management and risk assessment.

Tax Compliance and Planning (TCP)

The TCP discipline focuses on advanced tax concepts and strategic tax planning. It also addresses topics previously included in REG, such as:

- Personal Financial Planning: Covers retirement and education funding, risk management, and insurance.

- Estate and Gift Taxation: Emphasizes strategies for managing estate and gift tax compliance within personal financial planning.

- Entity and Individual Tax Compliance: Includes complex tax issues like incentive compensation, net operating losses, and owner contributions and distributions, as well as compliance requirements for tax-exempt organizations.

By consolidating these areas, TCP equips candidates with the specialized knowledge necessary for comprehensive tax advisory roles, combining compliance and strategic planning for both individual and entity taxation.

Which Order to Take the CPA Exams

You can choose to take the CPA exams in any order, depending on your strategy. Some recommend taking them in a certain order based on your strengths and what discipline section you choose. Here is one recommendation of what order to take the CPA exams.

CPA Exam Format and Administration

Here are some of the most important factors about CPA exam logistics:

- The exam is conducted in a computer-based format at Prometric testing centers.

- It comprises multiple-choice questions and task-based simulations, offering a blend of theoretical knowledge and practical application.

- The updated CPA Exam structure removes written communication tasks, which were previously part of the BEC section.

Scheduling

Starting in 2024, the CPA Exam testing schedule has shifted from a set-window format to continuous testing, providing candidates the flexibility to sit for their exams year-round. Previously, exams were limited to four specific testing windows—January-March, April-June, July-September, and October-December.

With continuous testing, candidates no longer need to wait for the next window to retake or reschedule a section, significantly streamlining the exam process. The only exception is a brief blackout period for system maintenance, making the exam more accessible and adaptable to candidates’ unique schedules and needs.

CPA Exam Cost

The costs associated with taking the CPA exam can vary by state, but there are general fees that most candidates will encounter during the process. Understanding CPA exam costs is crucial for effective planning and budgeting.

- Initial Evaluation Fee: Before taking the CPA exam, candidates typically undergo an evaluation of their educational credentials. The fee for this evaluation is generally around $90.00. This fee covers the cost of reviewing academic transcripts and other educational documents to determine eligibility for the exam.

- Fee for Each Section: Each exam section fee is around $348.80, but it varies by state. To get an accurate fee schedule, contact your state’s accountancy board. You’ll pay this fee every time you apply for an exam section.

Post-Exam Process

After completing the exam, candidates receive a notice of completion. Official scores are usually released by the AICPA and made available through the candidate’s state board of accountancy or NASBA account.

In the event that a candidate needs to retake a section, they can do so in a subsequent testing window, adhering to the retake policies set by the AICPA and their state board.

Historical Context of the CPA Exam: Origins and Evolution

The CPA exam’s origins date back to the early 1900s, marking the formalization of accounting as a regulated profession. Initially, the exam was paper-based and focused primarily on bookkeeping and basic accounting principles.

Over the decades, the CPA exam has evolved to include a broader range of topics, reflecting the expanding role of CPAs in auditing, taxation, business law, and financial management. The shift to a computer-based format in the early 2000s marked a significant modernization, introducing adaptive testing and simulation questions that better assess candidates’ practical skills.

The 2024 changes, under the CPA Evolution initiative, represented another significant milestone, adapting the exam to the increasing complexity and technological integration in the accounting profession.

Conclusion

Achieving the CPA credential is a rigorous but rewarding pursuit, demanding both a comprehensive understanding of accounting principles and the dedication to overcome a challenging exam. With the latest updates under the CPA Evolution, candidates are not only preparing for a credential but stepping into an accounting profession that’s continually adapting to modern demands.

Whether you’re an aspiring public accountant, a finance professional, or someone seeking to expand your expertise, the CPA path opens doors to leadership and success in the accounting and financial landscape.

Now go learn about which CPA prep course is best for you and get on your way to becoming a CPA.

FAQs

Candidates can take each section of the CPA exam up to four times a year during the designated testing windows. There is no limit on the total number of times a candidate can attempt the exam.

The passing score for each CPA exam section is 75 on a scale of 0 to 99.

Yes, candidates can choose the order in which they take the exam sections. However, it’s recommended to start with sections that align closely with your area of expertise or recent study.

Generally, CPA exam scores are valid for 18 to 30 months from the date of passing the first CPA exam section. Candidates must pass all four sections within this timeframe.

In some states, if you don’t pass all four sections within 18 months, the credit for the first passed section will expire, and you will need to retake that section. Other states allow for 30 months to complete all exams.

Yes, each section of the CPA exam includes a standard 15-minute break that doesn’t count against your exam time. Additionally, there are optional breaks that do count against the exam time.

No, candidates are not allowed to bring reference materials. However, authoritative literature is provided within the exam for certain sections.