Ever tried to untangle a really complicated knot? That’s what diving into the Regulation (REG) section of the CPA exam feels like. It’s all about wrestling with tax laws, navigating through tricky business regulations, and making sure you’re playing by the rules of professional ethics.

Recently, the CPA exam got a facelift, shaking up all the core sections, including REG. This means that even if you thought you knew what to expect, there’s some new stuff to learn. In this guide, we’ll break down what’s new, what’s tough, and what’s crucial to know about the REG section. Plus, we’ve got some straight talk from folks who’ve just taken the new version of the exam.

You’re in the right place if you’re gearing up to tackle REG or just curious about what it entails. Let’s make sense of this beast together, with no frills or fluff.

Key Takeaways

- Multidisciplinary Challenge: The REG section uniquely combines U.S. federal taxation, business law, and professional ethics, challenging candidates to apply a wide range of knowledge in practical scenarios.

- Evolving Exam Content: Recent updates to the CPA exam, including the REG section, reflect the evolving landscape of the accounting profession, with a particular emphasis on the application of technology in tax practices.

- Analytical Skills Emphasis: Mastery of the REG section requires not just memorization but the ability to analyze complex information and make informed decisions, highlighting the importance of staying current with tax laws and regulations.

- Preparation Strategies: Candidates preparing for the REG exam should focus on comprehensive review courses, practice exams, and staying updated on the latest tax laws to navigate this challenging section successfully.

What Makes the REG Section of the CPA Exam Unique

The REG CPA exam section holds a distinctive place among the three core sections due to its specific focus, structure, and the skills it tests. Here’s a concise overview of what sets REG apart:

- Taxation Deep Dive: REG goes deep into the nitty-gritty of U.S. federal taxation, covering everything from your personal taxes to the complex filings of big businesses. It’s a gold mine for those who love demystifying tax codes.

- Multidisciplinary Approach: The CPA REG exam isn’t just about crunching numbers; it’s a blend of law, ethics, and tax all rolled into one. It tests your ability to weave together different strands of knowledge and apply them in real-world scenarios.

- Tech-Savvy Taxation: Here, technology isn’t just a tool; it’s part of the test. REG pushes you to leverage tech and data analytics for smarter, more efficient tax preparation and compliance, setting it apart from more traditional exam sections.

- Hands-On With Tax Strategies: While other sections might have you memorize principles, REG gets you into the trenches of actual tax planning and compliance. It’s about applying what you know to real-life tax puzzles.

- Keeping Pace With Change: Tax laws are always on the move, and so is the REG content. This section requires you to stay sharp and current, turning you into a tax law trendwatcher.

- Analytical Acumen: In REG, knowing the rules is not enough; you need to understand how to apply them in complex, often tricky situations. This section is designed to stretch your analytical skills, asking you to interpret and advise on intricate tax matters.

“I personally thought REG was harder than FAR. With FAR, once you have a solid understanding of how transactions affect the financials you can apply that knowledge to pretty much any question they throw at you. With REG, it’s all rules based, which sucks because you just have to know the rules. You can’t use a lot of logic with REG just memorization.”

CPA Thread

REG Exam Structure and Skill Assessment

The REG CPA exam employs a mix of multiple-choice questions and task-based simulations to evaluate a candidate’s skills around this content:

- Federal Taxation of Individuals and Entities: This includes taxation principles related to:

- Taxable and nontaxable income

- Deductions and credits (adjusted gross income)

- Tax consequences of property transactions

- Tax obligations for various business entities (C corporations, S corporations, partnerships)

- Business Law: Key topics include:

- Legal requirements for digital signatures and contracts

- Bankruptcy filing processes and implications

- Employment law, including worker classification and related taxes

- Ethics and Professional Responsibilities: Candidates must demonstrate knowledge of:

- AICPA Code of Professional Conduct

- Treasury Department Circular 230 regulations

- Confidentiality and privacy laws impacting tax practice

- Application of Data and Technology in Tax Practice: Focusing on:

- Utilization of tax preparation software

- Digital verification of source data

- Application of automated validation checks

Understanding the Breadth of REG

“BEC, FAR, AUD were manageable IMO. After taking REG, I feel like my head was swollen. Was information overload. Way too many rules and phaseouts and thresholds and limitataions. Many of which are arbitrary / illogical and changes each year. Yea REG was a nightmare.”

CPA Thread

As one of the core CPA exam sections, REG is all about the intricacies of taxation, tackling how taxes apply to individuals and companies alike, alongside the specific considerations for property transactions. It doesn’t stop there, though; this section also demands a solid grasp of the ethical and professional standards guiding accountants, specifically highlighting the importance of compliance with the Treasury Department’s Circular 230 and a thorough understanding of the legal impacts of tax-related decisions.

Business Law and Its Implications

A substantial portion of the REG exam is dedicated to business law, underscoring its importance in the accounting profession. This area tests the candidate’s grasp of the legal aspects of business operations, including the formation, operation, and dissolution of business entities, contracts, and debtor-creditor relationships.

It also covers federal laws affecting businesses, such as employment tax obligations, the Foreign Corrupt Practices Act, and the implications of the Bankruptcy Abuse Prevention and Consumer Protection Act. Understanding these laws is crucial for advising clients and making informed decisions that comply with U.S. legal standards.

The Role of Data and Technology in Tax Practice

In today’s digital age, proficiency in utilizing data and technology for tax preparation and compliance is indispensable. The REG exam reflects this reality by incorporating tasks that require candidates to verify the completeness and accuracy of data, understand the outputs of automated validation checks, and apply diagnostic tools to identify and correct potential errors or anomalies in tax returns. This component highlights the evolving nature of the accounting profession and the increasing reliance on technology in tax practices.

REG Exam Study Tips: How to Pass the CPA REG Section

First of all, you’re going to need a CPA review course.

“I took reg same day as you and felt that Becker covered everything I needed to know 🤔 I ran into a good handful of cash gift basis, R6, & itemized deductions Qs tho, so it sounds like maybe the questions really are a toss-up. my most seen topic is book-to-tax.”

venicebleach2

The REG CPA exam tests some tough things, including federal tax procedures ethics, book and tax income, foreign tax credit implications, and more. A passing CPA exam score in the REG section requires a strategic study plan that emphasizes understanding over rote memorization. CPA candidates should focus on practice exams and task-based simulations to familiarize themselves with the exam format and types of questions asked.

Engaging with CPA prep courses that offer comprehensive coverage of the REG exam content can significantly enhance preparation. Key areas such as federal taxation, business law, and the ethical and professional responsibilities of tax practice should be at the core of one’s study regimen.

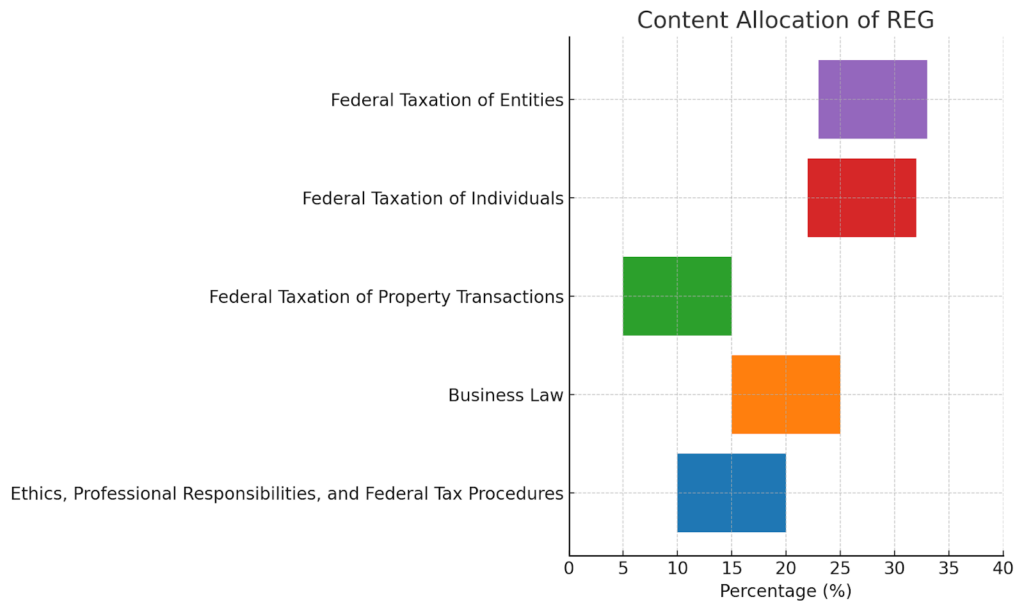

Content Allocation: Where to Focus Your Efforts

- Ethics, Professional Responsibilities, and Federal Tax Procedures (10-20%): This area delves into the ethical considerations and responsibilities in tax practice, requiring a solid grasp of Treasury Department Circular 230 and the intricacies of federal tax procedures and legal duties.

- Business Law (15-25%): Covering the legal implications of business transactions, this segment tests knowledge of employment laws, contracts, debtor-creditor relationships, and the selection, operation, and termination of business entities.

- Federal Taxation of Property Transactions (5-15%): This focuses on routine property transactions, including the basis and depreciation of assets, emphasizing the practical aspects of tax compliance.

- Federal Taxation of Individuals (22-32%) and Entities (23-33%): These sections form the bulk of the exam, covering tax compliance and planning for individuals and entities, from income recognition to the computation of tax liability and credits.

Skill Allocation: Sharpening Your Tools

The REG exam evaluates candidates across a spectrum of cognitive skills, from remembering and understanding basic concepts to the application and analysis of complex scenarios. This distribution ensures that candidates are not only familiar with the theory but can also apply their knowledge in practice.

- Deep Dive into Federal Taxation: Given its significant weight, a thorough understanding of federal taxation—both individual and entity—is paramount. Focus on understanding the nuances of tax law and the practical aspects of tax preparation and compliance.

- Master Business Law: Business law is not just about memorization; it’s about understanding the principles that govern business operations and transactions. Focus on agency, contracts, and the legal aspects of business entities.

- Practice Applied Research: The ability to apply research findings from the Internal Revenue Code and Treasury Regulations to real-world scenarios is crucial. Practice using these resources to answer complex tax questions.

- Embrace Technology and Data: Familiarize yourself with the technological tools and data analysis methods used in tax preparation. This includes understanding how to verify the accuracy of data and utilizing diagnostic tools to identify errors.

Conclusion

Wrapping up, the REG section of the CPA exam is your ticket to mastering the complex world of tax laws, business regulations, and ethical practices in accounting. It’s unique because it tests not just your knowledge, but how you apply that knowledge in real-world scenarios. With recent updates making the exam more reflective of today’s accounting challenges, it’s crucial to stay informed, practice with purpose, and lean into the resources available to you, including review courses and firsthand insights from recent test-takers.

Remember, tackling REG is a significant step in your accounting journey, setting the foundation for a successful career by ensuring you’re well-versed in the intricacies of regulation and taxation. Go into your study with a clear strategy, stay updated on the latest tax laws, and keep your analytical skills sharp. With determination and the right approach, you’ll navigate through the REG section and emerge ready to take on the accounting world.

FAQ

The CPA Evolution has introduced updates to ensure the REG section mirrors the evolving landscape of tax, law, and ethics in the accounting profession. Expect a sharper focus on the practical application of technology in tax practices and an updated emphasis on current tax laws and regulations.

Yes, familiarizing yourself with tax software can be beneficial. The exam incorporates tasks that mimic real-world scenarios, including the use of technology for tax preparation and compliance.

The REG section primarily focuses on U.S. federal taxation, including ethics and professional responsibilities related to tax practice, U.S. business law, and federal tax compliance for individuals and entities. International tax laws are not a primary focus.

Regularly reviewing updates from the IRS, the AICPA, and reputable tax law sources is crucial. Additionally, using a CPA review course that updates its materials to reflect current laws will help ensure you’re studying the most relevant information.

Business law is a significant portion of the REG exam, covering contracts, debtor-creditor relationships, and the legal environment of business. Focus on understanding the principles governing business entities, federal regulations affecting businesses, and the implications of major laws like the Bankruptcy Abuse Prevention and Consumer Protection Act.