As an experienced CPA and finance expert who has guided numerous finance professionals through their career process, I often get asked, “How long does it take to become an Enrolled Agent?”

Spoiler alert: The answer is around a year.

But unlike other designations like the CPA or the CMA, it’s not education and experience requirements for enrolled agents that take up a bulk of the wait time, it’s preparing for the Enrolled Agent exam (the Special Enrollment Exam.)

Thankfully, there are ways to cut this time drastically.

In this short article, I’ll go over parts of the Enrolled Agent timeline and give my tips for shortening it so you can represent clients much sooner.

Key Takeaways

- Overall Timeframe: The journey to becoming an Enrolled Agent typically spans around a year, influenced by your existing tax knowledge and exam preparation speed.

- Getting Started: The first step is to acquire a Preparer Tax Identification Number (PTIN) from the IRS, which takes just a few days to a week.

- Exam Preparation: Preparation for the EA exam is the most time-intensive part, potentially taking 6 months to 1 year, focusing on individual and business tax laws and representation practices.

- Exam Scheduling and Completion: Scheduling depends on test center availability, and you must complete all three parts of the exam within a two-year window.

- Maintaining Credentials: Once certified, maintaining your EA status requires ongoing continuing education, ensuring you stay updated on current tax laws and practices.

Timeline to Becoming an Enrolled Agent

Typically, the path to becoming an Enrolled Agent takes about a year, depending on your prior tax knowledge and how quickly you can prepare for and pass the EA exam. Passing the EA exam is the pivotal step in this journey, as it demands a thorough understanding of tax law as enforced by the Irs.

- Obtain a Preparer Tax Identification Number (PTIN)

- Duration: A few days to a week

- Tip: Apply online through the IRS website to get your PTIN quickly.

- Prepare for the EA Exam

- Duration: 3 months to 6 months

- Tip: Dedicate consistent daily or weekly study times using comprehensive EA review courses so that you can achieve passing scores.

- Schedule and Take the Exam

- Duration: Each part can be scheduled and taken separately. Each exam part is a few hours long.

- Tip: Take the exams as close together as possible within the 2-year window to keep the information fresh.

- Pass All Three Parts of the EA Exam

- Duration: Must be completed within 2 years of passing the first part

- Tip: Focus your studies on weaker areas if you don’t pass a section to improve quickly and retake it in the next available window.

- Apply for Enrollment and Pass a Suitability Check

- Duration: A few weeks to months

- Tip: Ensure you’re in full tax compliance and have no outstanding tax liabilities to speed up this process.

- Maintain Your Credential with Continuing Education

- Duration: Ongoing annually

- Tip: Plan your continuing education courses around your work schedule to stay compliant without disrupting your professional activities.

By following this timeline and incorporating these tips, you can more efficiently navigate your way to becoming an Enrolled Agent. Remember, while the journey requires commitment, the privilege of representing clients on a wide range of tax issues before the IRS is a rewarding professional achievement.

The EA Exam: Your Biggest Time Challenge

The IRS Special Enrollment Examination is the biggest hurdle you’ll face on your way to becoming an Enrolled Agent. It’s broken down into three parts, and each one digs deep into different areas of tax knowledge:

- Part 1 – Individuals: Aspiring Enrolled Agents deal with all things related to individual tax returns. This part of the exam covers filing statuses, deductions, credits, and all the little nuances of individual tax situations.

- Part 2 – Businesses: This part is all about understanding business tax preparation requirements. Whether it’s a giant corporation or a small mom-and-pop shop, you need to know how different entities handle their taxes. It includes everything from determining business income and expenses to handling payroll taxes.

- Part 3—Representation, Practices, and Procedures: This is where tax preparers learn to represent taxpayers before the IRS. It covers the rules of engagement with the IRS, including how to handle audits, appeals, and collection issues.

“I studied casually and passed the 3 sections in about 3-4 months. I overstudied but there’s some genuinely hard stuff in there. I remember having something like 8 questions about 1031 exchanges that were ridiculously obtuse. That said I had something like 6 years of experience and had done a whole bunch of business returns, which is generally harder than the individual portion.”

u/rh194jl

“I’m currently studying and sitting for part one at the end of the month. I’ve always heard people say 1 month per section. I really think it depends on your experience, though. I don’t think sitting down for a couple of hours a day for one month is going to be passable if you are new to it. Certainly not enough if you want to prepare quality returns afterward.”

dmagee33

The exam isn’t just a test; it’s a detailed sweep through the ins and outs of tax laws. It’s tough because it has to be—you’re being trusted to handle sensitive and complex tax matters.

Why an EA Exam Prep Course Can Help

Given the breadth and depth of the EA exam, diving into a top enrolled agent prep course can be a game-changer. Here’s why:

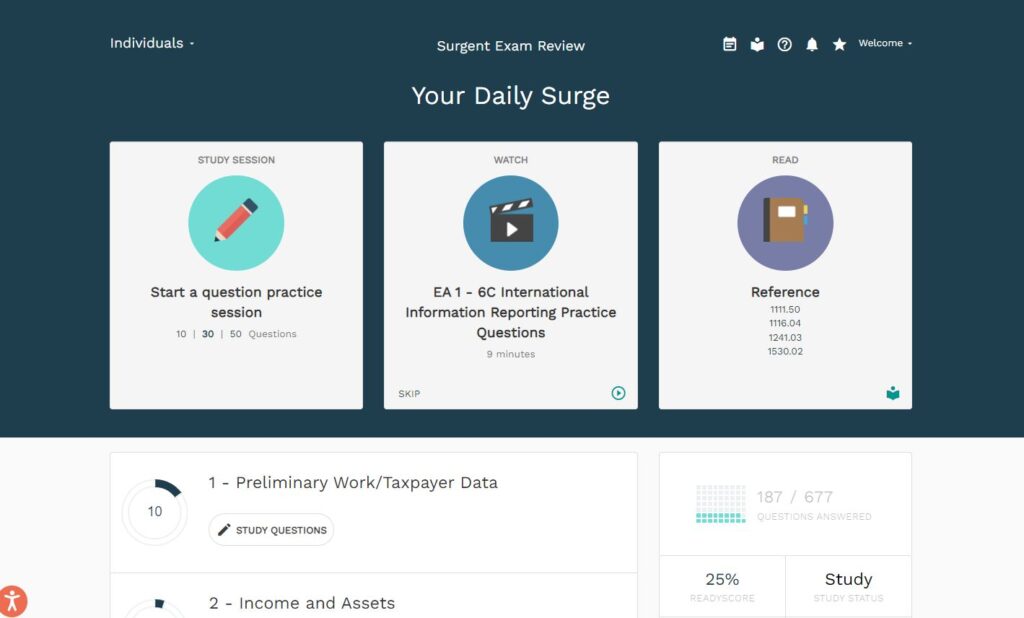

- Structured Learning: Prep courses break down massive volumes of information into manageable chunks. This structured approach makes it easier to tackle complex topics without getting overwhelmed.

- Practice Makes Perfect: Good prep courses offer tons of practice questions and simulations that mirror the actual exam. This not only helps you understand the type of questions to expect but also gets you into exam-taking mode and timing.

- Expert Guidance: Most courses are designed by experts who’ve been in your shoes and know exactly where the tricky parts are. Their insights can help you focus on what’s most important and avoid common pitfalls.

- Motivation and Support: Studying alone can be a drag. Being part of a course means you’re studying alongside others with the same goal. Plus, having instructors and peers to turn to when you’re stuck can keep you motivated.

Investing in a solid EA exam prep course might seem like just another expense, but it’s really about investing in your success. It can drastically cut down your study time and boost your chances of passing on your first try—getting you ready to represent clients and handle tax matters with confidence sooner rather than later.

“50 hours per each part is what I would recommend for the exam. I don’t know your level of tax experience, so it is hard to be concise. In this case, get to know the tax forms and common, pervasive themes in taxation that get all of us: WHO is a dependent – a qualifying relative or child and WHEN are they a dependent – Head of Household or for Schedule A purposes.”

the_undertow

Enrolled Agent Course Coupons

Check out these savings with our exclusive EA review course promo codes.

Final Thoughts

Embarking on the path to becoming an Enrolled Agent is a commendable goal that opens up numerous professional opportunities in the field of taxation. While it requires dedication and a significant investment of time—typically between one to two years—the rewards are substantial. By gaining this certification, you not only enhance your expertise in tax law but also earn the privilege to represent clients before the IRS, setting you apart in the tax profession. With strategic preparation and by taking advantage of resources like EA exam prep courses, you can streamline your journey to achieving this respected designation.

FAQs

You can retake the exam parts you fail during the next available testing window. It’s important to revisit your study materials and perhaps adjust your study schedule based on the areas you found challenging.

For each part of the EA exam, a fee of $259 is required, which must be paid when you schedule your appointment. Please note that this fee is non-refundable and cannot be transferred to another session or applicant.

No college degree is required to become an Enrolled Agent. All you need is a high school diploma or equivalent and to pass the EA exam. This opens the door to a tax career to a broader range of people.

Enrolled Agents specialize in tax matters and are federally licensed to represent taxpayers before the IRS at all levels. They become certified solely through passing the IRS Special Enrollment Exam. Certified Public Accountants, however, are licensed by state boards and have a broader practice scope that includes accounting, auditing, and financial consulting. CPAs must pass the Uniform CPA Examination and often meet specific educational and experience requirements. While both can handle tax issues, CPAs have a wider range of financial expertise.

As an EA, you gain unlimited practice rights, which means you can represent any taxpayer for any tax matter before the IRS. This is a significant advantage over other tax professionals who don’t have this credential.

An Enrolled Agent must maintain a high standard of tax compliance to retain their credentials. This means that while EAs can technically have tax debt, they must be actively engaged in a repayment plan or resolution approved by the IRS. Any unresolved tax debt or failure to comply with tax laws can jeopardize an EA’s license and their ability to represent clients before the IRS.

When taking the EA exam at a Prometric test center, you must arrive at least 30 minutes early with a valid, government-issued photo ID that matches your registration name. Personal items such as phones, bags, and notes are not allowed in the testing area; lockers are typically provided for storage. Expect security measures like metal detector scans and pocket checks. There are no breaks during the exam, and a strict silence policy is enforced to maintain a focused environment. An on-screen calculator is provided for calculations, eliminating the need for personal calculators.