As a CPA expert, the most common question I receive is: How much does the CPA exam cost? I wish the answer was a simple number that I could add to this first paragraph; you could read it and move on.

Unfortunately, this isn’t the case.

The main reason for this is that CPA exam fees and total costs vary greatly depending on where you live. Searching the NASBA will show you that examination fees vary widely from state to state, including the required registration fees, application fees, ethics exam costs (if there are any), and so on.

Although I can’t give you an exact CPA exam cost, I can give you a ballpark range. Keep in mind that these numbers always vary and depend greatly on what you’ll read below.

Key Takeaways

- Cost Range: Expect to spend between $1,569 and $7,879 on your CPA journey, factoring in application, evaluation, and examination fees, as well as CPA review courses.

- Financial Strategy: Efficient exam scheduling and thorough preparation can significantly reduce costs. Aim to pass each section on the first try to avoid expensive retake fees.

- Expense Reduction: Leverage discounts, financing, and employer partnerships to make review courses more affordable, helping to ease the overall financial burden of CPA exam preparation.

CPA Exam Cost Breakdown

To earn your CPA license, you must be declared eligible for the examination by the Board of Accountancy in one of the 55 U.S. jurisdictions. The fees include:

- An application fee that is established by and paid to your Board of Accountancy or CPAES.

- An examination fee established by the Boards of Accountancy, NASBA, the AICPA, and Prometric is paid either to your Board of Accountancy or CPAES.

CPA Exam Application and Evaluation Fees

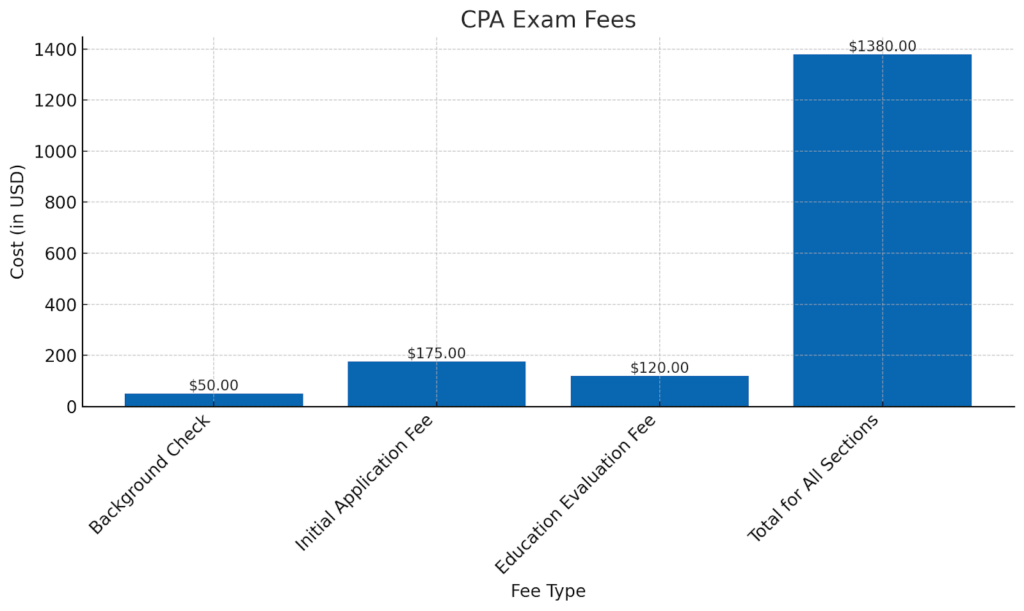

The initial application fee, a crucial initial step in your CPA exam journey, is a one-time, non-refundable payment of $50 to $300 made directly to the state board.

Some states require a separate education evaluation fee ranging between $90 and $150. The fee evaluates your educational background to determine your eligibility for the CPA exam. It ensures that your academic credentials meet the specific standards set forth for CPA candidates, facilitating a smooth entry into the examination process.

CPA Exam Fee

The exam registration fee is an essential component of the CPA exam process. Once upon a time, each CPA exam section had a varied fee: one might have been $175, and the next $195. This has changed.

Now, most states have a flat fee for each section that is the same across the board. Like most things with the CPA, this varies by jurisdiction. In this Reddit thread, CPA candidates discuss the rising costs, with some paying upward of $350.

When I examined all 50 states, the most common CPA exam section fee was $344.80. This is the case for Florida and the majority of other states. This fee, payable each time you register to take one of the four sections of the CPA Exam, contributes to the administrative and operational costs associated with scheduling and conducting the exam.

Using the fee above, the total for candidates planning to sit for all four sections without any retakes is $1,379.20. This fee structure underscores the financial commitment required for CPA candidacy and highlights the importance of thorough preparation to avoid the additional costs associated with retaking any sections.

Additional CPA Exam Costs

- Background Check: Some states require a background check, which can cost up to $50.

- CPA Review Course: This is a significant part of your preparation, and its costs range from $1,000 to $6,000.

- Lifestyle Expenses: Studying for the CPA exam may lead to additional costs, such as ordering takeout or hiring extra childcare, due to the time commitment required for preparation.

Total Cost Range for the CPA Exam

Given these factors, the total cost range for taking the CPA exam can vary significantly. A candidate could potentially start around $1,569 (at the lower end of application, evaluation, and exam fees, excluding CPA review courses and additional costs) and upwards of $7,879 (including the higher end of review course costs and additional expenses, but excluding potential retake fees and special circumstances).

Keep in mind that this does not include CPA licensing fees, ethics exam fees, or continuing professional education costs that are also required to receive and maintain a CPA designation.

Tips for Reducing CPA Exam Expenses

I always tell candidates that finding ways to alleviate CPA exam costs upfront can save you a lot in the long run. Here are some of my personal tips:

- Scheduling to Save: By planning your exam sections efficiently, you can minimize the number of application fees paid. Consider scheduling multiple sections within the same six-month period to save on costs (but only if you know you’ll have time to prepare!) Also, make sure that your schedule is open for that day and that there are no conflicting appointments since CPA exam rescheduling fee costs can really add up.

- Be Ready the First Time: The best way to avoid additional fees is to pass each exam section on your first attempt. CPA exam retake fees are expensive and can really add up.

- Choose the Right Review Course: Select a top CPA exam prep course offering a high investment return. Look for courses that provide a vast bank of practice questions, engaging lectures, and study plans tailored to your needs. Although this seems like a huge expense, it can help you avoid CPA exam retake fee costs.

- Discounts, Financing, and Partnerships: Explore discounts offered by prep course providers, such as Becker CPA promo codes or special rates through employer partnerships. Financing options like monthly payments can also make expenses more manageable.

Conclusion

Grasping the financial commitment required for the CPA exam, with total costs potentially spanning from $1,569 to $7,879, is essential for candidates. Strategic planning, such as consolidating exam sections within a six-month period and tapping into discounts and financing options for CPA prep courses, can significantly mitigate these expenses. This approach not only aids in managing the upfront costs but also paves the way for a successful journey toward becoming a CPA.

FAQ

The total cost can range from $1,569 to $7,879. This includes application and evaluation fees, examination fees, CPA review courses, and additional lifestyle expenses.

Application fees range from $50 to $300, and some states require a separate education evaluation fee between $90 and $150 to assess your eligibility for the CPA Exam.

Most states charge a flat fee of $344.80 per section. The total examination fee for all four sections without retakes is $1,379.20.

Yes, CPA exam fees, including application, evaluation, and examination fees, can vary significantly by state. For this reason, CPA candidates should check with their state boards for fee planning.

You can save money on CPA certification by scheduling multiple exam sections within the same six-month period to reduce application fees, investing in a comprehensive review course to pass on the first attempt, and exploring discounts, financing options, and employer partnerships for review courses.