Buy now, pay later (BNPL) apps are everywhere right now—an estimated 49% of Americans used one this year—and for good reason. BNPL services let you break up payments over time without relying on high-interest credit cards or draining savings you’d rather keep untouched.

I’ve now reviewed 10 and counting BNPLs, and here’s a fun twist: the two that gave me the most tech trouble were Sezzle and Zip. With Sezzle, I had a hiccup tied to an old phone number, but support fixed it in under 15 minutes. With Zip, I was locked out of my account entirely—and never fully resolved it. That alone set the tone for how these two compare.

So let’s get into it: Sezzle vs. Zip, side by side, with my personal experiences plus what real users say online.

Which One Should You Choose? Sezzle or Zip

- Choose Sezzle if you want predictable, interest-free payments: Sezzle gives you four equal installments over six weeks, no hidden interest, and the chance to build credit through Sezzle Up.

- Choose Zip if you want Visa-powered flexibility: Zip can be used almost anywhere Visa is accepted, including retailers where Sezzle isn’t partnered. But that flexibility comes with $1 fees on every installment and recurring glitches.

- Sezzle is better for everyday budgeting: It’s clean, transparent, and credit-friendly.

- Zip only wins if you need reach: If you want to swipe at a store that doesn’t take Sezzle, Zip’s virtual Visa card has you covered—but at a price.

Sezzle vs Zip Comparison

| Feature | Sezzle | Zip |

|---|---|---|

| Credit Check | Soft check only, no hard inquiry | Soft check only |

| Installments | 4 equal payments over 6 weeks | 4 equal payments (with $1 fee per installment) |

| Interest/Fees | Small service fee on most orders; clearly displayed | $1 fee per installment + late fees |

| Credit Reporting | Reports to all three bureaus if you enroll in Sezzle Up | Rarely reports; only negative activity may appear |

| Approval | Instant, flexible, no hard inquiry | Instant, but buggy; accounts sometimes freeze |

| Best Use | Everyday purchases + credit building | Flexibility when Sezzle isn’t accepted |

| Biggest Con | Small service fee | Fees + frequent app glitches |

Sezzle: Transparent and Credit-Friendly

Sezzle follows the classic Pay-in-4 model:

- 25% down at checkout

- Three more payments every two weeks

- All interest-free if you pay on time

What makes Sezzle different is Sezzle Up, an optional program that reports your on-time payments to all three major credit bureaus. That’s huge. Most BNPLs only ding your credit if you’re late—meanwhile, Sezzle rewards you for staying on top of payments.

I’ve used Sezzle for everything from car parts to a $439.96 order that felt much less stressful when split into four manageable chunks. Even with a small $7 fee rolled into the first payment, it beat the feeling of swiping a credit card and watching the interest pile up.

Bottom line: Sezzle isn’t just another BNPL—it’s one of the few that can actually help you build your financial future.

Zip: Flexible but Frustrating

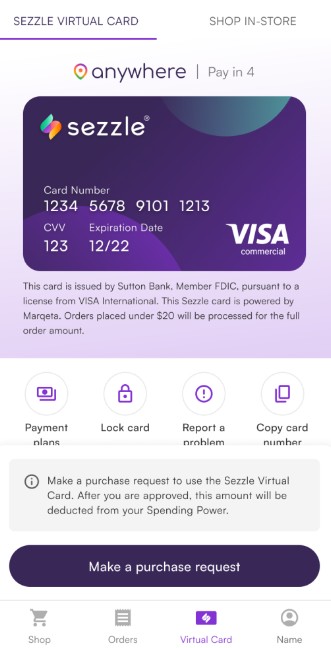

Zip looks good on paper: four payments over six weeks, accepted almost anywhere thanks to its virtual Visa card, and even a now-vanished Pay-in-8 feature that once let users stretch things further.

But when I tested Zip, I ran into persistent login and verification errors that left me unable to use the app. And I’m not alone—Reddit threads are full of complaints about phantom “past due” balances, vanished Pay-in-8 eligibility, and support teams that never resolve tickets. One user summed it up after losing the 8-part payment plan feature:

“Apparently if you reschedule even once, they remove Pay in 8 forever. I won’t support a company that does that.”

To make matters worse, Zip charges a $1 fee on every installment. It doesn’t sound like much, but with multiple orders, it adds up quickly. And while they’ll report you to collections if you default, they won’t reward you with positive credit history if you pay on time.

Zip’s only real win? It’s Visa integration. If you want to shop outside Sezzle’s partner network, Zip works more like a debit card. But reliability is another story.

Payment Plans and Flexibility

Sezzle keeps things straightforward: four predictable payments over six weeks, with one free reschedule per order. That built-in safety net makes a big difference if your payday shifts or life throws you a curveball. Even with a small upfront service fee, you know exactly what you’ll owe.

Zip also offers four payments, but each one carries a $1 fee over multiple purchases, which adds up. They briefly offered Pay in 8, but users across Reddit complain it disappeared without warning, especially if they ever rescheduled.

Winner: Sezzle wins for clear, reliable structure. Zip only wins if you need its Visa card to shop outside Sezzle’s partner network.

App and User Experience

When I first signed up for Sezzle, I hit a snag because my account was tied to an old phone number. Support had me verified and fixed in under 15 minutes, all via live chat. Since then, the dashboard has been clear, the reminders timely, and in-store use has been smooth through Apple Wallet and Google Pay.

Zip, on the other hand, was a headache. I never fully got in. Users also report ghost “past due” orders that freeze accounts, even when payments are current. Customer support often gives vague “wait 24–48 hours” responses, but some users have been stuck for months.

Winner: Sezzle. It’s not flawless, but it works consistently once you’re in.

Fees, Transparency & Credit Impact

Sezzle charges a small service fee on most orders, but it’s clearly displayed upfront. With Sezzle Up, your good habits can actually build credit—turning a budgeting tool into a stepping stone for your financial profile.

Zip piles on fees: $1 per installment, plus late fees if you slip up. And unlike Sezzle, you won’t see any credit boost for paying on time. In fact, if you miss too many payments, you might get a letter from collections—users online confirm this, saying they were shocked when overdue balances landed in third-party hands.

Winner: Sezzle, since even its small fees feel lighter than Zip’s ongoing charges—and it actually rewards good payment behavior.

Real-Life Scenario: My Trouble With Both

Out of 10+ BNPLs I’ve tested, the only two that gave me real tech trouble were Sezzle and Zip.

With Sezzle, my issue was tied to an old phone number, and their support resolved it quickly. I was back up and running in under 15 minutes, and I appreciated the extra security.

With Zip? I never got back in. Login errors, frozen accounts, and phantom balances made it impossible to test fully. Even Reddit users say they’ve been locked out for months without resolution.

That’s why, for me, Sezzle feels like a partner. Zip feels like a gamble.

Final Verdict

Both BNPL apps promise flexibility, but they deliver very different experiences.

✅ Sezzle wins for: predictable payments, transparency, and the rare ability to build credit through Sezzle Up.

❌ Zip only wins if: you want its Visa card to shop beyond Sezzle’s partner stores—but you’ll pay for it with fees and glitches.

If you’re serious about budgeting and want a BNPL that feels like it’s on your side, Sezzle is the clear choice.

Get started with Sezzle today and see why it’s my go-to BNPL app.

FAQs

Yes, if you enroll in Sezzle Up, all three major credit bureaus will receive notice of your on-time payments, which means Sezzle could help build your credit history.

Zip doesn’t usually report to the credit bureaus. Only negative activity (like collections) may show up. Positive payments don’t help your credit.

Sezzle charges a small service fee per order, clearly shown upfront, plus optional reschedule fees if you use more than one.

Zip adds a $1 fee to every installment, plus late fees if you miss a payment. Frequent users say the costs add up quickly.

Sezzle is better for predictable, short-term budgeting and credit building. Zip is only useful if you need its Visa card to shop where Sezzle isn’t accepted.