Buy now, pay later apps are everywhere right now—and for good reason. They let you break up payments over time without relying on high-interest credit cards or exhausting savings you’d rather not touch.

And the trend is only growing. In the U.S., BNPL made up around 3 % of total e-commerce spending in 2020, and that number is still climbing.

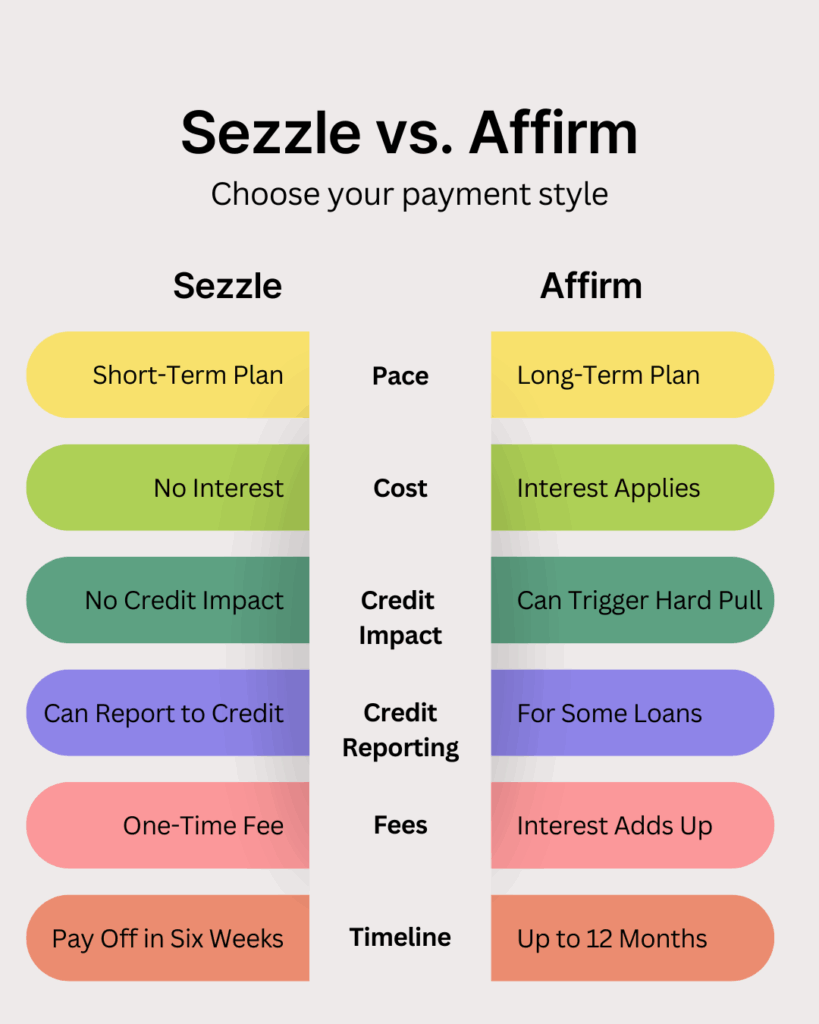

Two of the biggest players in the game? Sezzle and Affirm.

Whether you’re trying to stick to a budget, build your credit, or just make a big purchase feel a little less overwhelming, this guide breaks down the key differences, plus my own experience using both apps in real life.

Which One Should You Choose? Sezzle or Affirm

- Choose Sezzle if you want simple, interest-free payments: Choose Sezzle if you want interest-free payments, a simple 6-week plan, and the chance to build credit through Sezzle Up.

- Choose Affirm for long-term financing on big purchases: Choose Affirm if you need long-term financing options for larger purchases and have a stronger credit profile.

- Sezzle’s short-term plan supports everyday budgeting: Sezzle’s four equal payments make it ideal for everyday spending and monthly budgeting.

- Affirm gives you more flexibility, but often with interest: Affirm offers more flexibility with extended loan products, but often charges interest based on your credit.

- Sezzle is easier to qualify for than Affirm: Sezzle is easier to qualify for, while Affirm requires a better credit score to access the best payment options.

Sezzle vs Affirm Quick Comparison

| Feature | Sezzle | Affirm |

|---|---|---|

| Credit Check | No hard inquiry (soft check only) | Soft credit check (may trigger hard pull) |

| Installments | 4 equal installments over 6 weeks | Loan terms from 1–60 months |

| Interest | 0% for most users | 0–36% interest rates, depending on credit |

| Fees | Capped fees for late payments, no hidden fees | No late fees, but APR can apply |

| Credit Reporting | Reports to three major credit bureaus (if you enroll in Sezzle Up) | Reports to Experian |

| Approval | Instant approval decision, no damage to score | Requires a qualifying credit profile |

| Use | Online + in-store with virtual card | Online + in-store with Affirm Card |

| Get Started | Start Now | Start Now |

BNPL Showdown: Get to Know Each Company

Before you decide, it’s worth seeing how each BNPL provider works. Here’s how each stacks up.

Sezzle: Flexible, Interest-Free BNPL for Everyday Use

Sezzle is a buy now, pay later service that splits your purchase into four equal installments over six weeks—with no interest and no hidden fees. Sezzle links directly to your bank account and gives you instant approval decisions for most purchases.

Sezzle is accepted at online and in-store merchants, thanks to their virtual card, making it a go-to financial product for people looking to budget smarter.

One of the biggest benefits I found to Sezzle is their Sezzle Up option. With Sezzle Up, users can opt in to have their on-time payments reported to all three major credit bureaus—Equifax, Experian, and TransUnion.

This feature helps build a positive credit history over time, without requiring a hard inquiry. Unlike many later apps that only report missed payments, Sezzle gives users the chance to improve their credit while staying on a short-term, interest-free payment plan.

“They approved me for $550 “spending power” right off the bat, and my credit score is questionable. I’ve been loving it so far!… I’ve used it for car parts through AutoZone (online and in-store), a hotel stay, and my kids’ daycare tuition. Some stores even offer a higher spending power than on the main page.”

Reddit User

Starting in late 2025, FICO will launch new credit scores that include Buy Now, Pay Later data—meaning how you use services like Sezzle could impact your credit profile. While these scores won’t replace traditional ones, some lenders will begin using them to assess creditworthiness, making on-time payments more important than ever.

Sezzle

Affirm: Long-Term BNPL for Bigger Purchases

Affirm is another major player in the BNPL services space, known for offering loan terms from 1 to 60 months. It’s best suited for larger purchases like furniture, electronics, and travel.

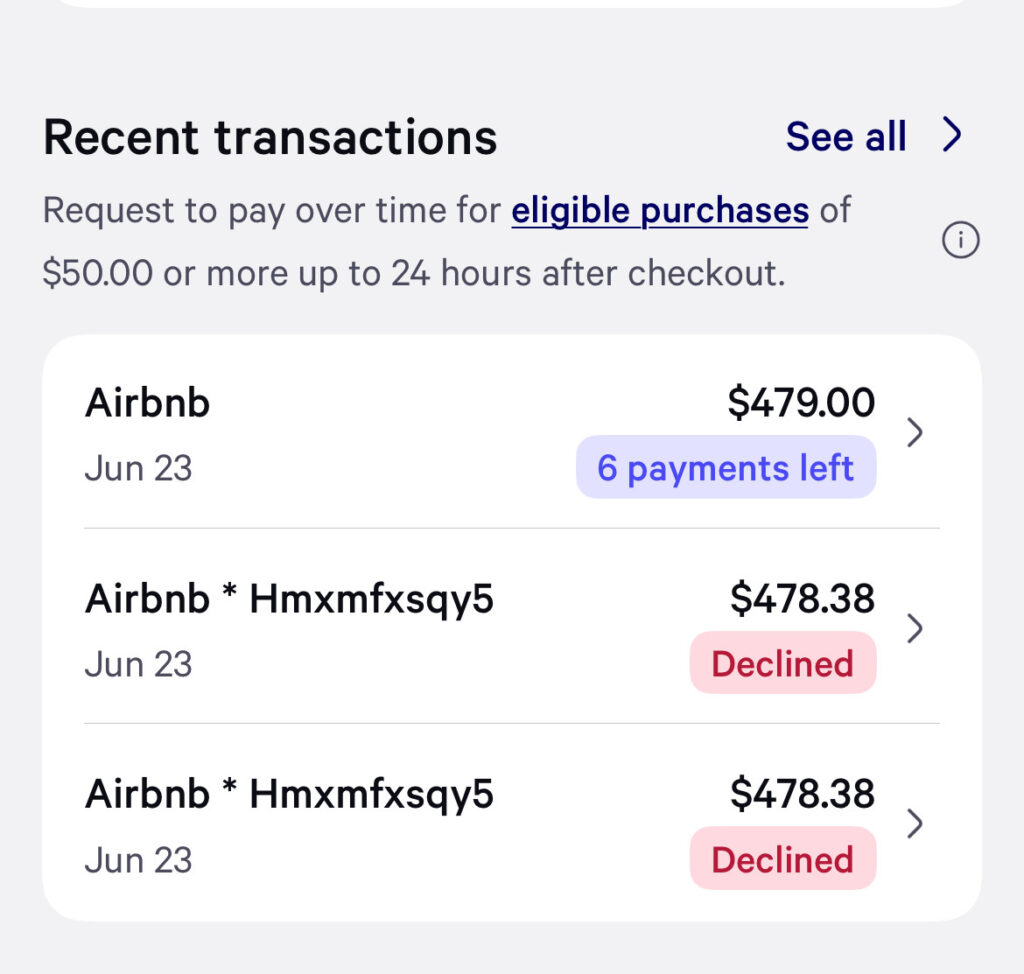

During my review process, I applied for buy now, pay later on a vacation I was booking.

I was daydreaming about being on a beach in Mexico, piña colada in hand, when I stumbled across the idea of using Affirm to book my getaway. That “Book Now, Pay Later” button was calling my name. So, I gave it a try.

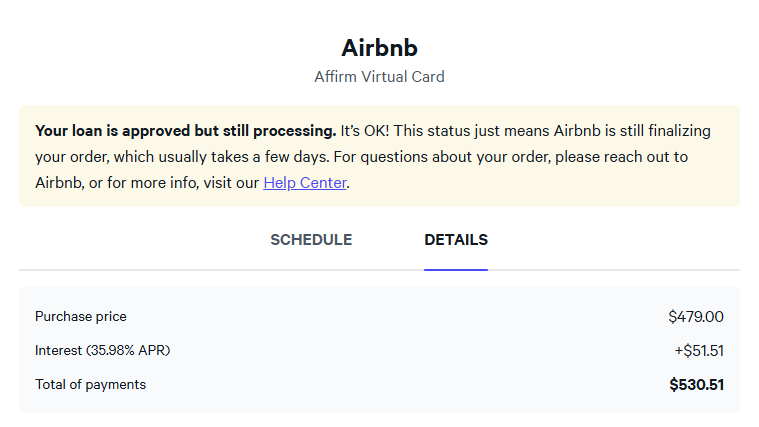

Affirm offers financing up to 60 months, which is ideal for bigger-ticket items like furniture, electronics, or — in my case — a well-deserved vacation. While some purchases qualify for 0% interest, be aware that rates can climb as high as 36% depending on your credit profile. The initial soft credit check doesn’t affect your score, but if you go through with the loan, it could trigger a hard inquiry.

The process was surprisingly smooth, and within minutes, I knew exactly what I’d owe, month by month. If you’re planning a major purchase (or a mental health break by the ocean), Affirm might be worth a look — just make sure to check the interest rate before you hit “confirm.” Choosing to pay the trip off within a couple of months offered no interest. However, spacing it into longer payment plans with low minimums did make the interest rates climb.

With that being said, the Affirm Card, a newer financing option, lets users pay the money back on what they spend over time at merchants that may not officially offer Affirm at checkout. I was approved for $1000 instantly, but again, it comes with the same potential for fees and interest.

Affirm

Payment Structure & Flexibility

Which brings me into a broader discussion on the payment structure of buy now, pay later options. Sezzle uses a straightforward 6-week payment plan with four evenly divided payments. It’s designed for personal finance needs like groceries, back-to-school shopping, or monthly bills. You pay 25% upfront (first payment) and repay the rest in three automatic payments.

Let’s say you’re buying a $200 back-to-school haul—clothes, supplies, maybe a new backpack. With Sezzle, you’ll pay just $50 up front, then three more equal payments every two weeks.

Affirm, on the other hand, gives you long-term payment flexibility—up to 60 months. That’s helpful for loan products with high price tags, but may include interest rates that increase the total cost of your purchase. The cool thing is that you get to pick your own plan out of several different options. But the longer you stretch it out, the more you’re likely to pay in the end, especially if your credit doesn’t qualify you for a 0% interest offer.

The Winner: Sezzle — for short-term, interest-free payment plan options and simpler finances.

Sezzle Up is one of the only Buy Now, Pay Later services that actively helps you build credit by reporting on-time payments to all three major credit bureaus: Equifax, Experian, and TransUnion. Even better? There’s no hard credit check, so enrolling won’t hurt your score.

To qualify, just:

✅ Pay off one order in full and on time

✅ Link your bank account as your default payment method

✅ Enter your SSN and verify your info

This feature is a game-changer if you’re trying to build or rebuild credit—whether you’re new to borrowing, bouncing back from financial challenges, or simply want more control over your financial future. By using Sezzle’s short-term, interest-free plans responsibly, you can make everyday purchases work for your credit, not against it.

Affirm, by contrast, only reports some loan activity to Experian, and not all users see that reflected in their credit profile. For example, small no-interest plans may not appear at all—meaning no progress toward your credit goals. Some users even report confusion about when or why their loan terms are reported.

With new FICO scores set to include BNPL activity, Sezzle Up puts users in a strong position to benefit. While not all BNPL services report to the bureaus, Sezzle’s consistent reporting means your responsible use could soon carry even more weight with lenders.

Real-world example? Say you’re planning to finance a new phone or a few months of groceries. With Sezzle Up, every on-time payment can work in your favor. With Affirm, you may not see the same results unless you’re using a high-value loan that gets reported.

The Winner: Sezzle — better for consistent credit-building without a credit hit or confusion.

📱 Tech & App Experience

Both Sezzle and Affirm offer sleek, easy-to-use apps with strong reviews, smooth navigation, and fast approval decisions. But the real difference shows up when you start actually using them.

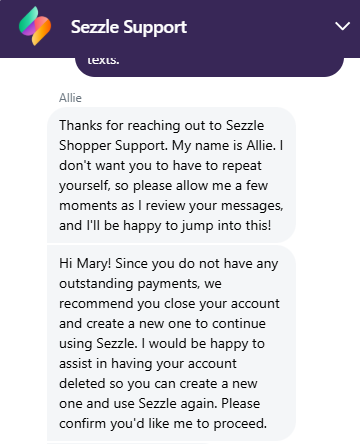

With Sezzle, I did run into a small hiccup during the sign-up process—my account was still tied to an old phone number, and I had to go through extra verification and eventually make a new account.

It was a little frustrating in the moment, but honestly? I appreciated the extra layer of security. Sezzle doesn’t just let anyone access your profile or borrow in your name, which made me feel like they were truly protecting my finances. Once I had support reset my account, I was good to go. The entire process took about 15 minutes through their chat, and I never had to talk to anyone on the phone.

With Affirm, the app was easy to use—I could find stores, check my options, and see what my payments would look like without much hassle. It felt a lot like online shopping. But here’s the catch: you have to set up your payment plan before you check out.

For example, when I tried to use Affirm for a vacation upgrade, I prequalified and selected a plan, only to find that once I added taxes and accessories, the total cost went up. That meant I had to leave checkout, re-adjust my loan amount in Affirm, and start the process again. It wasn’t a deal-breaker—but it definitely added some extra time.

So while both apps get high marks overall, they each come with their own quirks.

The Winner: Tie — Both apps work well overall, but neither is totally hassle-free. Sezzle feels more secure and is great if you’re using it in-store, while Affirm is easy to shop with—just be ready to tweak your plan if your total changes at checkout.

Fees, Interest & Transparency

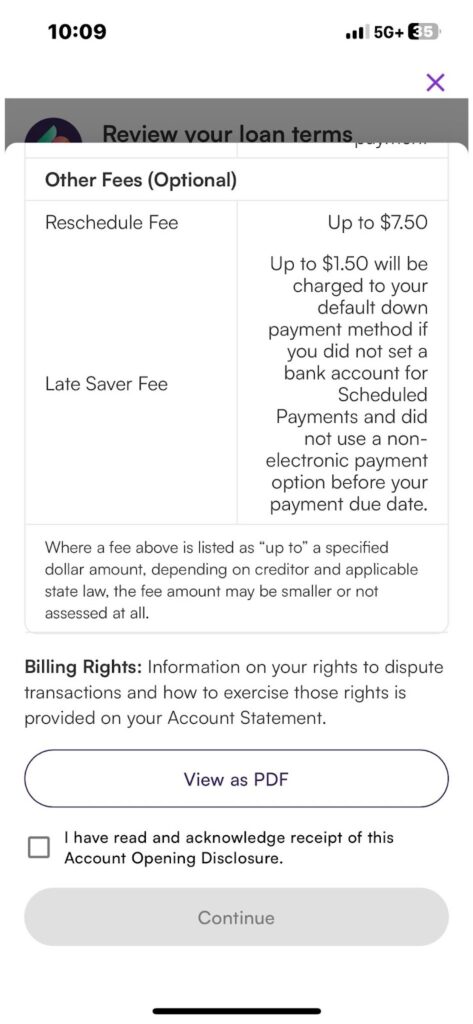

Sezzle doesn’t charge a monthly subscription fee and has no hidden fees, but there are a few charges to be aware of. Most purchases include a $6.99 service fee, which is rolled into the first payment. There’s also an optional reschedule fee of up to $7.50, and a late saver fee (up to $1.50) if your bank account isn’t connected and you miss a scheduled payment.

These fees can be frustrating—especially for people who prefer to use a debit card or don’t have access to a traditional bank account—but Sezzle clearly lays them out ahead of time. You’ll see and agree to them before you confirm your payment plan, which makes a big difference in terms of transparency. And even with those fees, it often still beats paying long-term interest.

Affirm takes a different approach: it doesn’t charge late fees, but it does use interest rates that vary based on your credit. Depending on your loan terms, a $400 purchase could end up costing well over $500 by the time you repay the full balance, especially if you didn’t qualify for 0%.

Let’s Break It Down: Purchase with Sezzle vs. Affirm

Sometimes the best way to see the difference is with real numbers. Let’s say you’re booking two round-trip flights for a weekend getaway. The total is $800—not something you want to put on a high-interest credit card, but also not something you can pay all at once.

Here’s how that same $800 flight purchase could play out with each app:

With Sezzle:

- Total Cost: $806.99

- Interest: $0

- Service Fee: $6.99 (included in first payment)

- Payment Schedule:

- 1st payment (today): $206.99

- 2nd payment (in 2 weeks): $200

- 3rd payment (in 4 weeks): $200

- 4th payment (in 6 weeks): $200

You’re done in a month and a half—with no lingering debt and no interest.

With Affirm (36% APR over 12 months):

- Monthly Payment: ≈ $80.76

- Total Cost: ≈ $969.12

- Interest Paid: ≈ $169.12

Even though you only pay about $80/month, you’re still paying for the item a year later, and you’re spending nearly $170 more for the convenience.

The Winner: Sezzle — While Sezzle’s small fees can add up, they’re clearly disclosed and generally lower than the interest you could pay through Affirm. For most people, Sezzle offers more predictable payments and fewer surprises.

Real-Life Scenario: Why I’ve Used Both Sezzle and Affirm

I’ve used both Sezzle and Affirm—and while each had its place, they taught me very different lessons about how I want to manage my money.

Last year, I used Affirm for a once-in-a-lifetime concert experience. The tickets, hotel, travel—the whole thing added up fast. It was one of those “I’ll regret not going” moments, and I didn’t have the full amount upfront. Affirm let me stretch the payments over 12 months, which felt manageable at the time. I accepted the interest, thinking it was worth it for the memory.

But honestly? Every time that payment came out of my account for the rest of the year, it was a gut check. The concert was amazing, but reliving the cost over and over made it harder to enjoy in hindsight. By the end, I wished I’d saved up a little more or found a shorter-term payment plan.

More recently, I used Sezzle to book a flight. It was a last-minute thing, and I needed a way to split the cost without dragging it out for months. Sezzle let me pay in four equal installments over six weeks, with no interest and no long-term commitment. It was easy, fast, and once the final payment cleared, I was done.

Both apps helped when I needed them, but if I can make a bigger down payment, I’ll choose Sezzle every time. It keeps things simple, short-term, and off my plate faster.

I’ve used both, and here’s the honest truth: they both got me through when I needed them. But one left me with payments I dreaded, and the other felt like a clean break once it was done.

If you’re looking for a short-term solution—something to split up a flight, a back-to-school run, or even an unexpected bill—Sezzle is the better option. It’s fast, interest-free, and over in six weeks. You know exactly what you’re paying, when, and why. And with Sezzle Up, your on-time payments can even help build your credit without a hard inquiry.

Affirm can make sense if you’re making a larger purchase and absolutely need to stretch the cost out over time. I’ve used it for that exact reason. But the interest adds up fast, and the longer you carry that balance, the heavier it starts to feel.

Final Verdict

So who wins?

✅ Sezzle comes out on top for most people—especially if you want to:

- Avoid paying interest rates

- Use a clear, short-term payment plan

- Build credit by sending info to major credit bureaus

- Get approved with no damage to your score

- Pay in-store and online with a virtual card

Get started with Sezzle and see for yourself.

FAQs

Yes. If you enroll in Sezzle Up, your payments are reported to all three major credit bureaus.

Yes. Some loans are interest-free, but many come with a wider range of APRs up to 36%, depending on your credit.

No monthly subscription fee. You only pay what you owe—plus a small late fee if you miss a payment.

Sezzle is more accessible with no hard inquiry, making it easier for people with less-than-ideal credit scores to get started.

Yes. Both offer in-store use—Sezzle via virtual card, and Affirm through the Affirm Card.