I’ve been curious about buy now, pay later apps for a while, especially with prices going up and credit card interest rates climbing. I wanted a way to budget more easily without digging myself into debt.

That’s when I started researching installment payment apps.

Also known as BNPLs, these companies allow you to make purchases upfront and split the total into smaller payments. One of the most popular options, Sezzle, has been on my radar (and probably yours too, if you’re reading this article).

After spending time reading reviews, browsing the Sezzle app, and even trying it out myself, here’s everything I learned about one of the best installment payment options out there.

Sezzle Might Be for You If…

- You want to budget better without credit card debt—splitting payments into four interest-free chunks just makes life easier.

- You get paid biweekly, or you like the idea of spreading out costs for things like groceries, back-to-school gear, vacations, or even emergency expenses.

- You like having the option to report your on-time payments to credit bureaus through Sezzle Up, especially with new FICO credit scores expected to include BNPL data starting

- You shop both online and in stores and want something that works seamlessly with Apple Wallet or Google Pay.

- You appreciate clear terms and flexible tools—like rescheduling payments, avoiding hidden fees, and tracking everything in one clean app.

Sezzle

What Is Sezzle?

Sezzle is a buy now, pay later app that lets you split your total purchase price into four payments over six weeks. You make your payment today (25% of the total plus a small service fee), then pay the rest in three interest-free installments. It’s fast, flexible, and super easy to use.

You can use it online and in-store with top-name retail partners, and you’ll get an instant approval decision with no hard credit check. (My favorite part.)

For example, let’s say I needed to replace my car battery—it was $160, and payday was still a week away. With Sezzle, I could pay $40 upfront and cover the rest over the next few weeks. No interest, no stress, and I didn’t have to put it on a high-interest credit card.

How Does Sezzle Work?

Once you download Sezzle, you can start shopping at your favorite online stores. Based on your credit history and other factors, you’ll have a Sezzle buying power that works somewhat like a credit limit. This can range between $50 and $2,500, but most new users start somewhere between $100 and $500. Currently, I have $950 available for Sezzle purchases, but this number has increased over time.

When checking out, simply select Sezzle as your payment method. Most of the time, it is integrated with the store’s regular checkout flow, so you don’t have to jump through hoops to use it.

Here’s what happens:

- You pay 25% upfront (your payment today)

- The rest is split into three equal Sezzle payments

- The installment payment options are interest-free if paid on time

- You can easily reschedule payments if needed (once per order for free)

You’ll get email reminders before payments are due, and you can log in anytime to view your schedule, monitor spending, and see your available balance. Signing up is pretty straightforward, and the app does a nice job of helping you keep tabs on upcoming payments and due dates. I really liked that everything was clearly displayed—no hidden fees, no confusion.

Sezzle Set-Up and Support

That said, I did run into a small issue during setup. I had used Sezzle once, back in 2019, with an old phone number, and couldn’t access the account when I tried to sign up again. At the time of writing, I wasn’t able to reset it on my own, but I reached out to customer support via live chat—and they were great. Within 15 minutes, they had deleted my old account and helped me create a new one from scratch. The fix was quick, and once I got through that, everything worked smoothly.

Your Sezzle dashboard is also super easy to navigate. You can view upcoming payments, track your spending, and manage multiple purchases all in one place, without feeling overwhelmed.

Another thing I noticed is how flexible it feels. Life happens, and sometimes a paycheck hits late or a bill pops up. Sezzle lets you shift your due date once per order for free, which helped me stay on track without stress. And when I tested that feature, it actually worked without any hidden clicks or confusing steps.

Where Can You Use Sezzle?

One thing I love about Sezzle is how many places you can actually use it. You’re not locked into a small list of brands—in fact, Sezzle works with over 47,000 merchants. I used it at one of my favorite online boutiques and also spotted it at checkout for a major electronics site.

You can use the Sezzle app for:

- Clothing and fashion

- Electronics and tech gadgets

- Furniture and home décor

- Travel and wellness services

- Select medical bills, like dental work or glasses

- Even gift cards (from certain retailers)

Just be aware that not every store offers Sezzle in-store—some are online only. But with more businesses adding it all the time, your options keep growing.

Is Sezzle Really Interest-Free?

For most orders, yes. As long as you stick to the due dates, you’ll enjoy interest-free installments with no finance charges tacked on.

That said, there are a few situational fees you should know about:

- $6.99 service fee – Charged on most orders and included in your first payment

- Up to $7.50 reschedule fee – If you reschedule a payment more than once

- Up to $1.50 late saver fee – If you don’t have a bank account linked as your default payment method and miss your payment

- Late payment fee – Typically small and capped, but still worth avoiding

I checked a few carts at different stores while writing this, and the purchase price stayed consistent with the Sezzle total—unless I tried to push a payment back more than once.

So while Sezzle isn’t 100% fee-free in every case, they’re upfront about the costs, and you’ll always see any charges before confirming your plan. No hidden surprises.

Compared to other BNPL providers like Affirm, which can charge up to 36% APR over long repayment terms, Sezzle’s flat, low-cost structure feels much more predictable—especially if you can handle the short 6-week timeline.

Want to see how they compare side by side? Check out my full Sezzle vs. Affirm breakdown here.

Who Is Sezzle Good For?

If you’re trying to budget more easily, shop responsibly, and avoid interest charges, Sezzle makes a lot of sense. It’s especially useful for:

- Students and families with back-to-school costs

- Online shoppers who are looking for transparent shopping

- Anyone without a credit card who still wants consumer financing options

That said, service restrictions apply, and Sezzle financing isn’t available with every retailer. Some retail partners may also limit spending with Sezzle based on account history.

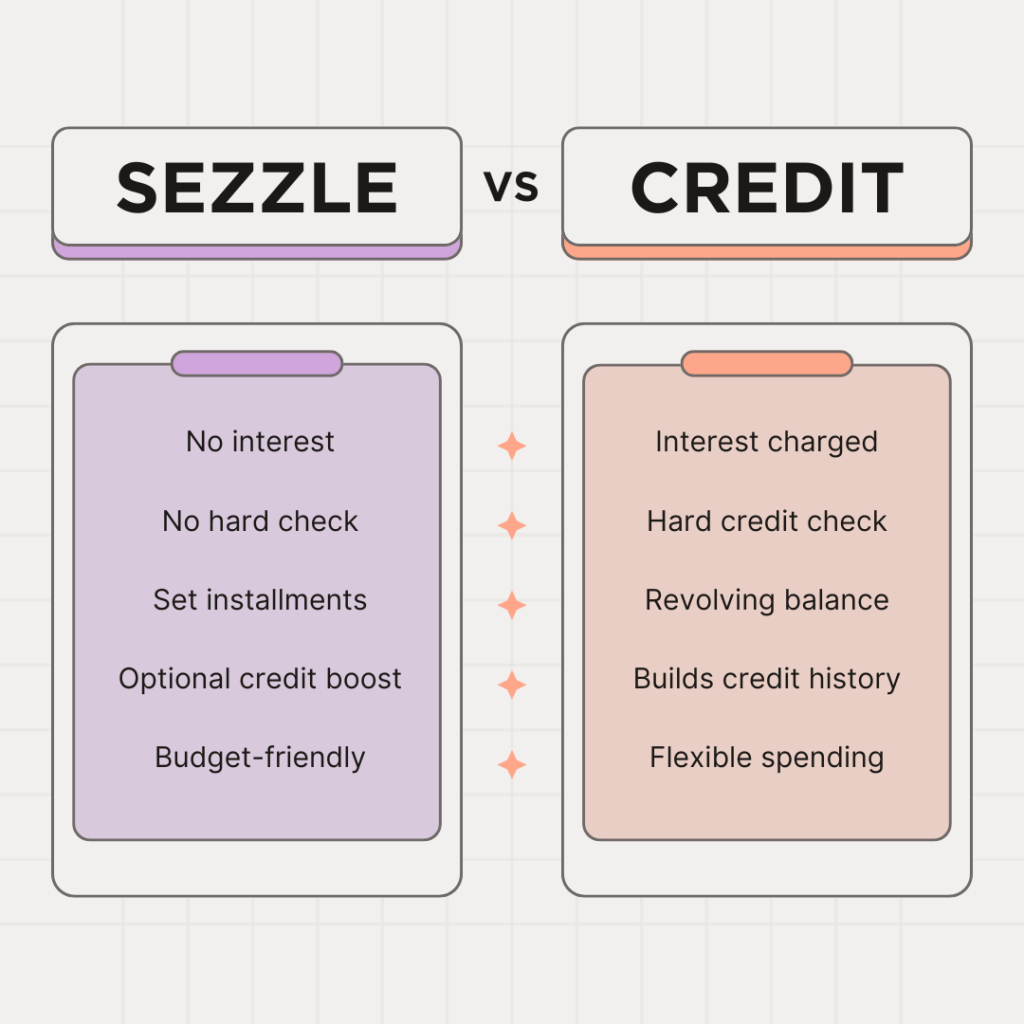

Sezzle vs Credit Cards

A lot of people wonder—why not just use a credit card? I get it. But for me, Sezzle offers a few major advantages:

- No revolving debt

- No compounding interest

- No temptation to overspend just to hit a rewards threshold

Credit cards charge interest if you don’t pay in full, while Sezzle’s model is interest-free as long as you follow the rules. You know exactly what you’ll pay and when, making it easier to plan ahead.

What Makes Sezzle Different?

Besides the seamless experience, I liked how Sezzle encourages financial responsibility. It’s not just about spending—it’s about spending smart.

Here are a few features that really stood out to me:

- Sezzle Up: Sezzle gives you the option to report your payment history to the credit bureaus. If you’re working on improving your credit, this gives users more visibility over their financial habits. While some other BNPLs also report, Sezzle Up offers a transparent, opt-in system that many users appreciate.

- Apple Wallet and Google Pay Integration: I loved that I could use Sezzle through my digital wallet in-store. It makes everyday purchases—like groceries—feel more manageable. Zip also offers this, but Sezzle’s setup was faster and less glitchy in my experience.

- Easy-to-Use App: The app was super easy to navigate. I always knew what I owed, when it was due, and where to find everything. The automatic updates and real-time payment reminders were helpful, and nothing felt confusing or buried in menus.

- Exclusive Deals with Retailers: Sezzle sometimes partners with merchants to offer limited-time Sezzle promotions. I noticed this around the holidays and back-to-school season. Affirm tends to focus more on big-ticket items and longer-term financing, while Sezzle feels more accessible for everyday shoppers.

Looking ahead: FICO will begin including BNPL payment data in select credit scores starting in late 2025. That means responsible use of services like Sezzle may soon play a bigger role in how lenders evaluate you. While traditional scores still carry the most weight, opt-in features like Sezzle Up could offer more visibility into your financial habits.

How to Enroll in Sezzle Up

If you’re aiming to build credit and want to get started with Sezzle, upgrading to Sezzle Up is free and pretty straightforward. Here’s how to do it:

- Pay off at least one Sezzle order in full and on time.

- Link your bank account as your default payment method (this step is required to qualify).

- Enter your Social Security Number and confirm your personal info in the app.

Once you’re enrolled, Sezzle will start reporting your payment history to all three major credit bureaus: Equifax, Experian, and TransUnion. You can even track your reporting status right in the app under the “Sezzle Up” section of your account dashboard.

⏳ Heads up: It may take up to 90 days for Sezzle to show up on your credit report, but it will reflect on-time payments month by month moving forward.

Best part? You won’t lose access to Sezzle Up if you later decide to use a debit card or change your payment method; you just need to meet those initial requirements.

Sezzle: What Works and What to Watch For

Sezzle has a lot going for it, but it’s not without a few quirks. Here’s a quick breakdown.

Highlights

- Use It (Almost) Anywhere With Sezzle Anywhere: With the Sezzle Anywhere feature, users can pay virtually anywhere that accepts tap-to-pay, including nail salons, vets, car repair shops, and even restaurants. It works through your phone’s digital wallet, making it a surprisingly flexible buy now, pay later tool—even outside retail shopping.

- Acts Like a Payday Reminder (In a Good Way): Multiple Reddit users mentioned that Sezzle helped them align purchases with payday. The predictable payment schedule serves as a helpful reminder, especially for folks who like structure or are actively budgeting.

- Short-Term Emergency Buffer: Some users have used Sezzle in a pinch, between paychecks or for unexpected expenses like pet care or groceries. It’s not marketed as a loan for emergencies, but it can function that way responsibly in real-life scenarios.

- No Interest… and No Shame: Despite the stigma around “pay later” apps, many users praised Sezzle for helping them access what they needed without debt spirals. If paid on time, it’s genuinely interest-free and fee-transparent, making it a solid option for people who want flexibility without judgment.

- Fast Refunds (Eventually): While communication isn’t always perfect, multiple Reddit users confirmed that Sezzle does refund transactions when there’s an issue (like a retailer not processing the order). It might take a few days, but it does happen—usually without fighting.

Considerations

- Customer Service: Mixed Reviews, But a Good Experience Personally: Some users report frustration with Sezzle’s support, especially when trying to reach a real person. Most issues are handled through chat or email, which can feel slow or impersonal if you’re expecting live help.

That said, my experience was smooth. I worked with a rep named Allie, and she was helpful and fast. My issue was resolved in about 15 minutes, and I even received a full support history emailed to me automatically, which I really appreciated.

- New Payment Method Restrictions: Sezzle has recently updated its payment method preferences, and some users have noticed a shift. While you can still use a debit card, Sezzle now encourages users to link a bank account or use its prepaid balance feature for smoother transactions. If you choose to pay with a debit card instead of ACH (bank transfer), there’s a $1.50 processing fee.

This change is clearly outlined in the user agreement when you register, so it’s not hidden—but it’s something to be aware of if you prefer using a card over a bank account. For most users, linking a bank account helps avoid extra fees and keeps the payment schedule more predictable.

BNPL Company Comparisons

Sezzle vs. Klarna

Klarna offers both pay-in-4 and longer-term financing options, but extended plans may involve a hard credit check, and not all purchases will reflect on your credit score. This means credit building with Klarna is inconsistent and not guaranteed.

Sezzle, by contrast, keeps things simple. With Sezzle Up, you can opt in to have your on-time payments reported to all three major credit bureaus, without a hard inquiry. That gives users a clear, low-risk path to building credit.

Bottom line: If you want clear, opt-in credit reporting and no hard pull, Sezzle offers a more transparent approach than Klarna, especially as credit scoring models begin factoring in BNPL data more broadly.

Sezzle vs. Zip

Zip (formerly Quadpay) and Sezzle both let you split purchases into four interest-free payments. However, Zip typically charges a $1 convenience fee per payment, which adds up over time.

Sezzle helps you avoid those extra fees when you pay with a bank account, making it a more budget-friendly option. Plus, Sezzle’s simple setup and payment reminders make it easy to stay on track with your spending goals.

Bottom line: Bottom line: Unlike Zip, Sezzle helps you avoid extra fees and offers optional features that support financial wellness—including tools that may help improve your credit profile over time.

Sezzle vs. Affirm

Affirm is known for financing large purchases with longer-term monthly payments (up to 36 months), but many plans include interest charges and credit checks. It’s great for high-ticket items like furniture or tech, but not always ideal for everyday spending.

Sezzle keeps it short and simple—just four interest-free installments, no hard credit check, and a clear repayment schedule. I find that it is more accessible if you’re trying to avoid debt or stick to a monthly budget.

Bottom line: Sezzle is more budget-friendly than Affirm for everyday purchases—no interest, just four simple payments.

Sezzle vs. Afterpay

Both Sezzle and Afterpay let you split purchases into four interest-free payments and offer user-friendly apps for managing your spending. Afterpay focuses on a seamless shopping experience, but it limits flexibility in how you pay or manage your account.

Sezzle, on the other hand, offers more control. You can link a bank account to avoid extra fees and access features like rescheduling payments or setting up budget reminders—tools that support long-term financial wellness.

Bottom line: While Afterpay is sleek and simple, Sezzle gives users more flexibility and payment control—making it a solid choice for budget-conscious shoppers.

Final Thoughts: My Sezzle Review

After trying it out for myself, I can honestly say Sezzle just makes sense. It takes the pressure off when something pops up that you need to buy now, but don’t want to put on a credit card.

The whole process felt straightforward. Sign-up was easy, payments were clear, and I always knew what I owed and when. I love that it’s interest-free if you stay on track, and it didn’t feel like I was getting trapped in any long-term debt.

If you’re someone who likes to plan your spending, avoid interest, or just needs a little breathing room between paychecks, Sezzle is a solid tool to have in your back pocket. I’ll definitely keep using it—especially for last-minute flights, back-to-school stuff, or when I just need a little more flexibility.

FAQs

Not if you pay on time. You get interest-free payments, but actual fees are reflected if you reschedule more than once or miss a due date.

Potentially. Sezzle Up reports on-time payments to the major credit bureaus. And with new FICO scores set to include BNPL data, this reporting may carry even more weight with lenders over time.

Technically, yes—you’re entering a loan agreement with set payment plans. But it doesn’t feel like one because there’s no annual percentage rate (APR) unless you miss payments.

Yes, with select retailers. You can shop in-store today using your Apple Wallet or Google Pay.

Yes. It’s trusted by thousands of merchants, offers transparent shopping, and is easy to manage through the Sezzle app.