I’ll be honest: I haven’t actually used a Buy Now, Pay Later (BNPL) plan for jewelry myself. I have used BNPL plenty of times for other purchases, but when it comes to something like a gold necklace or diamond studs, I’d rather save up.

Still, while researching this article, I found myself eyeing a few pieces (including a chain I probably don’t need) and realizing just how many different financing options are out there.

Jewelry isn’t just an accessory—it’s often tied to milestones, from engagement rings to birthday month splurges. But the price tags can sting, especially for gold chains, diamond studs, or designer pieces.

Here’s what to know before you check out with a BNPL option.

Key Takeaways

- Jewelry Purchases Fit BNPL Perfectly: Expensive single items like gold necklaces or engagement rings are often financed with monthly payments instead of being paid up front.

- Credit Approval Matters: Many lenders run soft checks, but larger jewelry purchases may require a full credit card agreement or separate credit plan.

- Minimum Purchase Required: Some programs require a set threshold (like $50 or $150+) to qualify for financing jewelry.

- Flexible Payment Plans Exist: You can choose interest-free options like Pay-in-4 or longer financing options with lenders such as Affirm or Klarna.

- Hidden Fees and Late Fees: Be aware of billing period rules, down payment requirements, and possible interest if you miss or extend payments.

Why People Use BNPL for Jewelry

A jewelry purchase isn’t just about style; it’s often about meaning. An anniversary necklace, a birthday bracelet, or a graduation ring can feel like investments in memory-making. But they’re also big-ticket items.

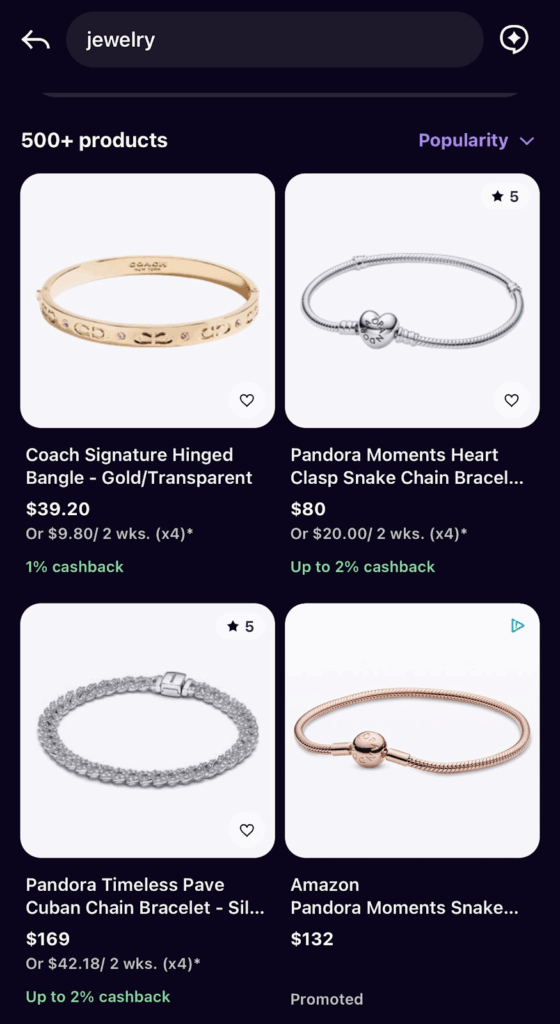

For example, a simple Pandora bracelet may cost $80, while a gold Cuban chain at Target could reach $300, and engagement rings can easily exceed $5,000. BNPL allows customers to manage those leaps in price with payment options that fit their budget.

Where to Buy Jewelry with BNPL

BNPL is widely accepted across jewelry retailers, both in-store and online:

- Kay Jewelers – Often offers separate credit plans arranged pursuant to Comenity Bank, alongside BNPL.

- Target – Uses Affirm loan services as well as Sezzle options, with purchasing power limits like those shown in my example.

- Macy’s – Offers Klarna and Affirm for jewelry purchases, sometimes tied to seasonal credit card offers.

- Amazon – Provides BNPL checkout option plus marketplace sellers offering pay-later flexibility.

- Pandora & Coach – Sell directly online, with Pay-in-4 plans shown at checkout.

- Ross-Simons & other jewelers – Some use lending partners, and most can be purchased with a virtual card.

And even if your jeweler doesn’t advertise BNPL, services like Sezzle Anywhere or Affirm’s single-use virtual cards can be added to your digital wallet for checkout.

Save $15 on Your First Amazon Purchase via Sezzle App

How the Payments Actually Work

Jewelry spans a wide range of prices. Here’s what a BNPL purchase could look like.

| Plan Type | Payment Example | Total Cost | Notes |

| Pay-in-4 (Sezzle) | $75 every 2 weeks | $300 | No interest if paid on time |

| 6-Month Plan (Klarna, 19% APR) | ~$54/month | ~$324 | Not always interest-free |

| 12-Month Plan (Affirm, 15% APR) | ~$27/month | ~$324 | Adds ~$24 interes |

Pro Tips:

- Check for minimum purchase requirements ($50–$150 is common).

- Always read the account terms because BNPLs aren’t always interest-free.

- Remember, add-ons like resizing, shipping, or warranties can raise the balance.

Engagement Rings and BNPL

Engagement rings are in a league of their own when it comes to financing jewelry. Unlike a pair of earrings or even a $1,200 gold chain, these purchases often reach into the thousands of dollars—and with that, BNPL providers apply stricter account terms.

Many jewelers now partner with BNPL services to make these big-ticket purchases more approachable. For example, Brilliant Earth offers extended pay-over-time options, as do other major jewelry stores.

Here’s an example of how BNPL might look for a $3,000 engagement ring:

| Plan Type | Payment Example | Total Cost | Notes |

| Pay-in-4 (Sezzle) | $750 every 2 weeks | $3,000 | Rarely offered at this price level |

| 12-Month Plan (Affirm, 15% APR) | ~$270/month | ~$3,240 | Adds ~$240 interest |

| 24-Month Plan (Klarna, 19% APR) | ~$150/month | ~$3,600 | Easier monthly payments, but adds ~$600 interest |

| Retailer Promo Offer (e.g., Brilliant Earth, Zales, James Allen) | Varies | Varies |

BNPL can make an engagement ring purchase feel less intimidating, especially if it is as simple as Pay-in-4. Keep in mind, though, these purchases usually involve loan services with eligibility checks, potential down payments, and ownership terms arranged pursuant to third-party lenders. Always review the full terms before committing — especially if interest kicks in after the promotional period.

Hidden Costs to Watch

BNPL makes jewelry shopping smooth, but it can also mask extra costs:

- Shipping and Insurance: Jewelry often requires secure shipping or insurance fees.

- Warranties and Resizing: Common with engagement rings and gold chains.

- Down Payments: Some BNPL accounts require a partial upfront payment.

- Multiple Shipments: Buying from different stores in one BNPL account may be split into separate billing periods.

- Previous Purchases Affect Approval: If you already carry BNPL loans, your eligibility check may lower your approval odds or spending power.

Timing Your Jewelry Purchase

Jewelry pricing fluctuates heavily during certain seasons:

- Valentine’s Day sales

- Mother’s Day promotions

- Graduation (May/June)

- Holiday shopping (November/December)

BNPL allows you to lock in sparkling savings during these events without draining your budget in one single transaction.

Final Thoughts

BNPL has made it easier than ever to buy jewelry, from $40 silver earrings to $1,200 gold necklaces. Services like Affirm, Klarna, and Sezzle give customers flexible financing options, sometimes tied to separate credit plans or minimum purchase requirements.

The catch? Options depend on the store and your eligibility check. Some programs are interest-free, others carry hidden fees or stricter account terms. And many are arranged pursuant to lending partners like Affirm LLC or Comenity Bank, not the retailer itself.

Bottom line: BNPL can help you upgrade your jewelry collection today, but always review the full terms before you sign—so your sparkling purchase doesn’t come with unwanted surprises.

FAQs

Yes, jewelry is one of the most common categories for BNPL, from earrings to engagement rings.

Most services run a soft eligibility check, but larger items may require a full credit plan or credit card agreement.

Many programs require $50 or $150 minimums, though some engagement ring plans may be higher.

Late fees, down payments, and interest after promotional periods can all apply, depending on the provider.

Major names like Kay Jewelers, Macy’s, Amazon, Target, Pandora, and Coach all allow BNPL, often through Affirm or Klarna.