If you already love using Sezzle for online shopping, the Sezzle Virtual Card takes it to the next level. It’s a quick, flexible way to split purchases into four interest-free payments—both in-store and online—without pulling out a credit card.

I’ll be honest: I first tried Sezzle because I wanted to grab a few things before payday without dipping into savings.

Then I found out about the Sezzle Virtual Card, and it changed how I shop. Now, whether I’m buying skincare at Ulta, grabbing headphones at Target, or ordering something from a small business online, I can pay smarter and still stay on budget.

Key Takeaways

- Works anywhere Visa is accepted: The Sezzle Virtual Card can be used online or in stores through Apple Pay or Google Pay.

- Links directly to your Sezzle account: Your installment plan, bank account, and payment deadlines are all managed inside the Sezzle app

- Splits purchases into four interest-free installments: You pay every two weeks—no interest or hidden fees when you pay on time.

- Single-use or reusable (with Sezzle Up): Regular users generate a single-use card for each transaction, but Sezzle Up members get a reusable virtual card for ongoing purchases.

- Helps manage cash flow and larger purchases: It’s perfect for spreading out payments on bigger buys while keeping your cash flow balanced.

What Is the Sezzle Virtual Card, Exactly?

Think of it as a digital payment method powered by Sezzle. Instead of paying everything up front, you make a purchase request in the app, get instant approval, and Sezzle issues you a virtual Visa card with a set limit.

Once you complete your purchase—online or in-store—Sezzle covers the full purchase price, and you pay them back in four interest-free installments over six weeks.

It’s simple: no credit card required, no high interest rates, and no waiting until payday to shop responsibly.

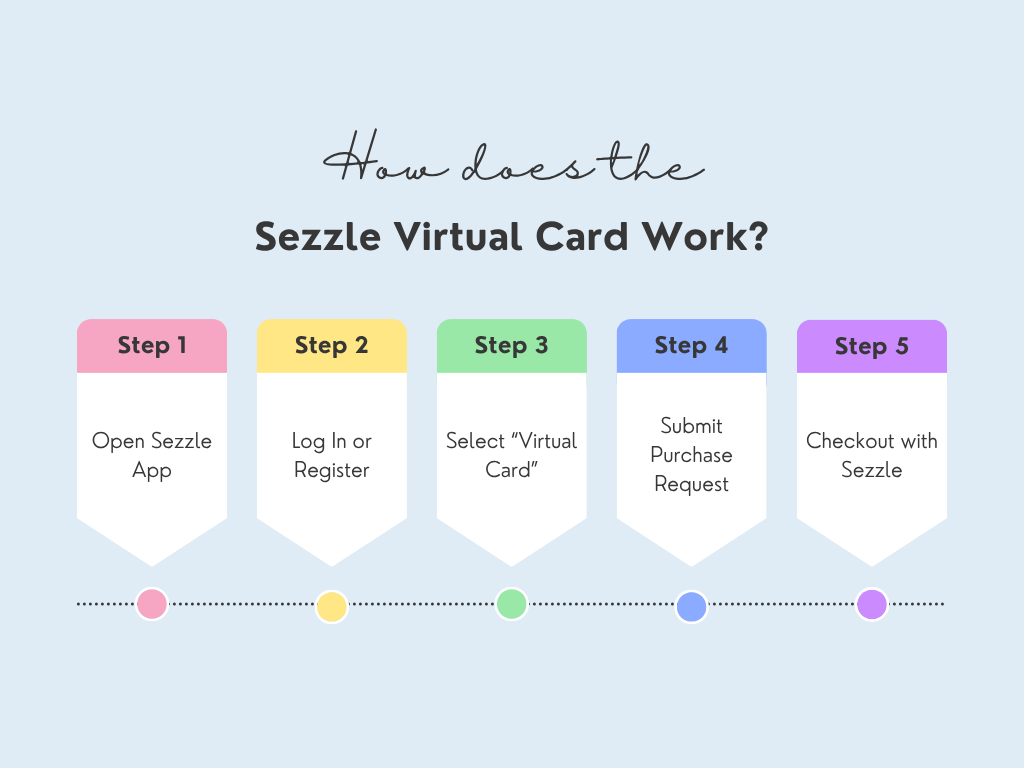

How to Use the Sezzle Virtual Card (Step-by-Step)

- Open or download the Sezzle app.

Log in to your account or register if you’re new. - Tap the “Virtual Card” tab.

You’ll see your spending limit and the option to create a new card. - Make a purchase request.

Enter the total purchase amount. Sezzle instantly approves the limit and generates your virtual card info—card number, expiration date, and CVV. - Check out as usual.

Whether you’re shopping online or in-store, choose your Sezzle card to split payments at checkout. - Make your first payment.

Your first installment (25%) is charged at checkout. The remaining three payments follow automatically every two weeks.

💡 Pro Tip: If you’ve upgraded your account to Sezzle Anytime or Everywhere, your card doesn’t have to be single-use anymore. You’ll unlock a reusable virtual card that works like any other stored payment method in your digital wallet. It’s perfect for frequent Sezzle app users.

Using the Sezzle Virtual Card In Store

Using Sezzle in-store feels like using Apple Pay or Google Pay through your mobile wallet. You simply hold your phone near the payment terminal, and your Sezzle Virtual Card does the rest.

Let’s say your total at the register is $120 for new workout gear. Sezzle pays the merchant upfront, and you pay Sezzle back in four payments (the first immediately, and the next three every two weeks).

You can always view your payment schedule, due dates, and remaining balance in the app, making it easy to stay organized and avoid late fees.

Using the Sezzle Virtual Card for Online Shopping

If you are like me and you prefer shopping online, your Sezzle Virtual Card works wherever Visa is accepted. Just copy the virtual card number, expiration date, and CVV from the app, and paste it into the “Payment Method” field at checkout.

Even if a store doesn’t have Sezzle as an official option, it can still be a preferred payment method thanks to the Sezzle virtual card option. Many major retailers also integrate Sezzle directly into their checkout, meaning fewer steps and faster approval.

Managing Payments and Staying on Track

Inside the Sezzle app, you can view:

- Each installment payment and due date

- Which payments are completed, upcoming, or rescheduled

- Your total purchase amount and remaining balance

Some users can even reschedule one payment per order for free, which is helpful if payday doesn’t line up perfectly. Just make sure to pay on time to keep your Sezzle account in good standing.

While Sezzle doesn’t usually report regular payments to credit bureaus, Sezzle Up users can have their payment activity reported, which can positively impact their credit score over time.

Why the Sezzle Virtual Card Makes Sense

For me, the virtual card feels like the perfect middle ground—it lets me enjoy the things I want while keeping my budget steady.

Here’s why people love it:

- Works with Apple Pay and Google Pay for easy in-store checkout

- Helps manage cash flow on larger purchases

- Keeps interest-free installments automatic and transparent

- Great for anyone who prefers using a debit card instead of credit

- Optional Sezzle Up reporting to credit bureaus for responsible users

It’s the kind of tool that gives you flexibility without adding financial stress—a little breathing room when life (and shopping carts) get full.

A Few Things to Know Before You Tap “Pay”

- The standard Sezzle Virtual Card is single-use unless you upgrade.

- Missed payments can lead to small late fees or account suspension.

- You must connect a valid debit card or bank account to manage payments.

- Sezzle assumes the full purchase price upfront, so stay on top of your payment deadlines.

Final Thoughts: A Smarter Way to Shop and Pay Later

The Sezzle Virtual Card brings together everything people love about buy now, pay later—speed, security, and flexibility. Whether you’re making an in-store purchase through Apple Pay or checking out online, it keeps you in control.

And if you take it one step further with Sezzle Up, it becomes more than a payment method—it’s a credit-building tool that rewards on-time payments with real financial progress.

I use it because it helps me balance the fun of shopping with the peace of financial mindfulness. No interest, no pressure; just smarter spending.

FAQs

Add it to Apple Pay or Google Pay, then tap to pay at checkout. Sezzle covers the total, and you pay it back in four installments.

Yes! You can copy your virtual card details from the app and use them anywhere Visa is accepted, even if the store doesn’t list Sezzle as an option.

Only if you’re enrolled in Sezzle Up as a Standard Sezzle user don’t have payments reported, but Sezzle Up users can build a credit history.

Yes, there are no fees or interest as long as you pay on time.

Sezzle is the base BNPL platform. Sezzle Up unlocks credit reporting, higher spending limits, and a reusable virtual card for frequent shoppers.