A 2025 Motley Fool Study estimates that up to 60% of Americans have used Buy Now, Pay Later services on a purchase. You’ve probably seen it while shopping online: that tempting little button that says “Pay in 4.”

It sounds easy—and it usually is.

Buy now, pay later services like Sezzle, Affirm, Afterpay, and Klarna make it possible to split a purchase into smaller payments. Four biweekly payments instead of one big charge? Yes, please.

But here’s the question the 60% needs to ask: How does BNPL affect your credit score—now and in the near future?

If you’re trying to protect or build your credit, you’ve got to be strategic about how you borrow—even if it’s just a $100 pair of shoes. BNPL loans aren’t the same as credit cards or personal loans, and their effect on your credit is changing fast.

Key Takeaways

- Not All BNPL Use Affects Credit Reports: Many short-term BNPL plans (like “Pay in 4”) still don’t appear on your credit report—yet.

- Missed Payments Can Still Hurt: Some providers may report missed or late payments, which could negatively impact your credit.

- BNPL Credit Reporting Is Expanding: Providers like Sezzle and Affirm offer opt-in reporting, and new FICO scores in late 2025 will begin including BNPL data.

- Easy to Forget, Easy to Miss: With automatic payments and no paper bills, it’s easy to overlook a due date if you’re not paying attention.

- Each Provider Plays by Its Own Rules: Credit impact varies by provider, plan type, and whether the data is reported to a bureau.

The Basics: How BNPL Works

Before we talk credit scores, let’s break down how BNPL actually works.

When you choose a BNPL option at checkout, you’re entering into a short-term loan. You typically make four interest-free payments over six weeks—25% upfront, followed by three auto-drafts. It’s often called a “pay in 4” plan.

Some providers also offer longer-term installment options with monthly payments (and sometimes interest). In most cases, there’s no hard credit check required.

BNPL has exploded because it’s convenient, accessible, and feels less risky than credit cards, especially for smaller purchases.

So… Does BNPL Affect Your Credit?

Short answer: It can—and soon, it’s more likely to.

Right now, not all BNPL providers report your activity to the credit bureaus. That means many BNPL loans won’t show up on your Experian, Equifax, or TransUnion credit reports—unless something goes wrong.

That cuts both ways. If you’re always on time, it might feel like a lost opportunity to build credit. But if you’re late? Some providers still report missed payments.

Here’s the current landscape:

- Some longer-term BNPL plans are treated like traditional installment loans and show up on your credit report.

- Most short-term “Pay in 4” plans still go unreported.

- Some missed payments do get reported, even if the original loan wasn’t listed.

And here’s what’s changing: FICO will soon launch new credit scores that include BNPL data—using info shared with Equifax. These new scores, like FICO 10T BNPL, will give lenders a more complete picture of your repayment behavior.

So while BNPL may not affect your credit today, it very well might by next year—even if your provider doesn’t directly report each loan.

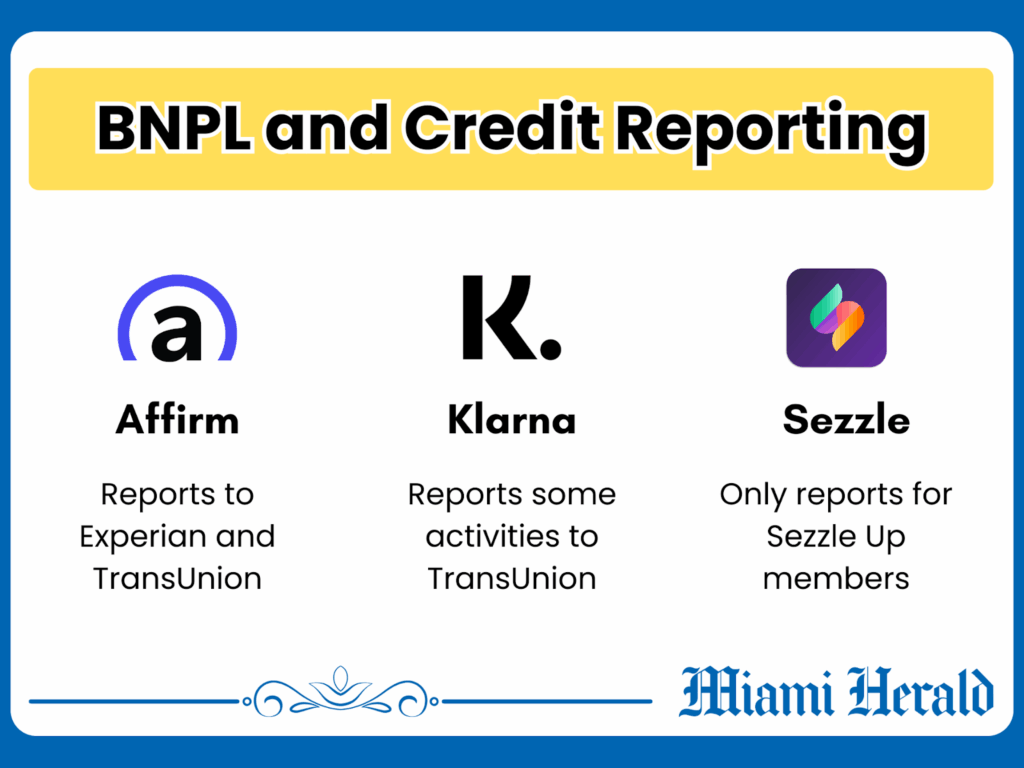

Who Reports What: A Quick Guide

Want to know if your BNPL activity could appear on your credit report now—or soon? Here’s a simplified overview:

| Provider | Current Reporting Behavior |

|---|---|

| Affirm | Reports most plans to Experian and sometimes TransUnion |

| Afterpay | Doesn’t report to bureaus currently |

| Klarna | Reports select loans to TransUnion |

| Sezzle | Offers Sezzle Up: opt-in reporting to TransUnion |

| Zip | Varies depending on the plan and merchant |

Keep in mind: Even if a provider doesn’t report your payments today, they may show up in your credit profile once lenders begin using the new BNPL-aware FICO scores in late 2025.

Why This Matters for Your Credit Score

Let’s talk about the score itself. Your credit score is built from several factors:

- Payment history (this is the big one)

- Credit utilization

- Length of credit history

- Credit mix

- New credit/inquiries

BNPL loans typically don’t affect most of these, unless they’re reported. But payment history is king, and if a BNPL provider sends a missed payment to collections or flags it to a bureau, your score could take a hit.

The tricky part? BNPL bills don’t always “feel” like credit. There are no paper statements, just auto-drafts. And that makes them easy to forget.

I’ve missed a BNPL payment before—not because I didn’t have the money, but because I wasn’t paying close enough attention. It happens fast. And even small loans can do damage if they get reported late.

Should You Use BNPL to Build Credit?

If building credit is part of your financial goals, Sezzle is one of the few BNPL providers offering a clear path forward. With Sezzle Up, users can opt in to report on-time payments to TransUnion—no hard credit check required.

That’s a big deal. While most short-term BNPL plans still don’t show up on your credit report, Sezzle gives users a chance to build positive credit history with consistent, responsible use.

And with FICO’s new credit scoring models set to include BNPL data starting in late 2025, using Sezzle Up now could help position you well for the future.

If you want to go even further:

- Use a secured credit card and pay the balance in full each month.

- Join a credit-builder loan program through your bank or credit union.

- Keep all existing accounts—including Sezzle—paid on time.

Sezzle Up stands out in the BNPL space by offering a proactive way to support your credit goals—today and tomorrow.

Final Thoughts

Buy now, pay later can be a helpful tool—if you use it wisely. It makes large purchases more manageable and avoids interest when paid on time. But it also carries risks, especially if you’re juggling multiple accounts or overlooking auto-pay schedules.

BNPL activity may not always appear on your credit report, but that’s beginning to change as credit scoring models evolve to reflect modern borrowing habits.

Bottom line: Treat BNPL like real credit. Pay on time. Use it with intention. And if building your credit is part of your plan, look for providers that offer clear, responsible reporting options.

FAQs

Not usually, but it can be. Missed payments may be reported and can damage your score, even on small balances.

Yes. Overspending, missed auto-payments, and unclear reporting can all create problems, especially with multiple open BNPL plans.

It depends. Affirm reports most loans. Klarna reports some. Sezzle offers opt-in reporting through Sezzle Up. Afterpay typically does not report.

Yes. Most BNPL services don’t require high credit scores and often don’t do hard credit checks for short-term plans.

Sezzle, Afterpay, Klarna, and Affirm are among the most used BNPL platforms in the U.S.