According to HomeAdvisor, if you want to furnish your American home, expect to spend an average of $16,000. Most people can’t afford to spend that much at once, but that shouldn’t get in the way of your ability to make your house feel like a home.

That’s where Buy Now, Pay Later furniture comes in.

Instead of dropping a chunk of change all at once, you can spread your purchase amount into bite-sized payments. With options like fixed monthly payments or short-term plans that split your total into four payments, BNPL has made it possible for a lot of people to upgrade their space without draining their savings.

But is it worth it? And which furniture stores actually offer these plans? I’ll break it all down in this guide.

Key Takeaways

- Pick BNPL for Flexibility: Most services let you split furniture costs into four payments or stretch them into longer plans.

- Pick Affirm for Big Purchases: It’s ideal for full-room sets or pricier items since it offers fixed monthly payments.

- Pick Afterpay or Sezzle for Smaller Buys: These work well for accent chairs, lamps, or smaller pieces at select furniture stores.

- Pick Klarna for Options: Klarna partners with retailers like Wayfair, offering both short-term and longer-term financing.

- Pick Carefully to Avoid Fees: BNPL can help, but late fees or high-interest plans can turn a smart choice into a costly one.

How Buy Now, Pay Later Works for Furniture

BNPL services step in at checkout and give you flexible payment options. Instead of charging everything to a credit card, you can pick a plan that fits your budget. Here are the basics:

- Short-Term Installments: Services like Sezzle let you split your purchase into four payments, usually interest-free.

- Longer-Term Loans: Providers like Affirm or Klarna let you stretch payments over several months with fixed monthly payments, often with interest.

- No Credit Card Needed: Many BNPL apps allow you to link a debit card or bank account instead.

It sounds simple, but there are downsides. Miss a due date and you could get hit with late fees, and if the plan is arranged pursuant to a lending agreement, you might face interest charges that add up fast. Still, I recommend Sezzle’s interest-free options if you don’t have the cash to put down all at once.

Popular Furniture Stores with BNPL Options

The cool thing about BNPL is how widespread it’s become. Whether you’re shopping online or in-store, there are plenty of places where you can take advantage of it.

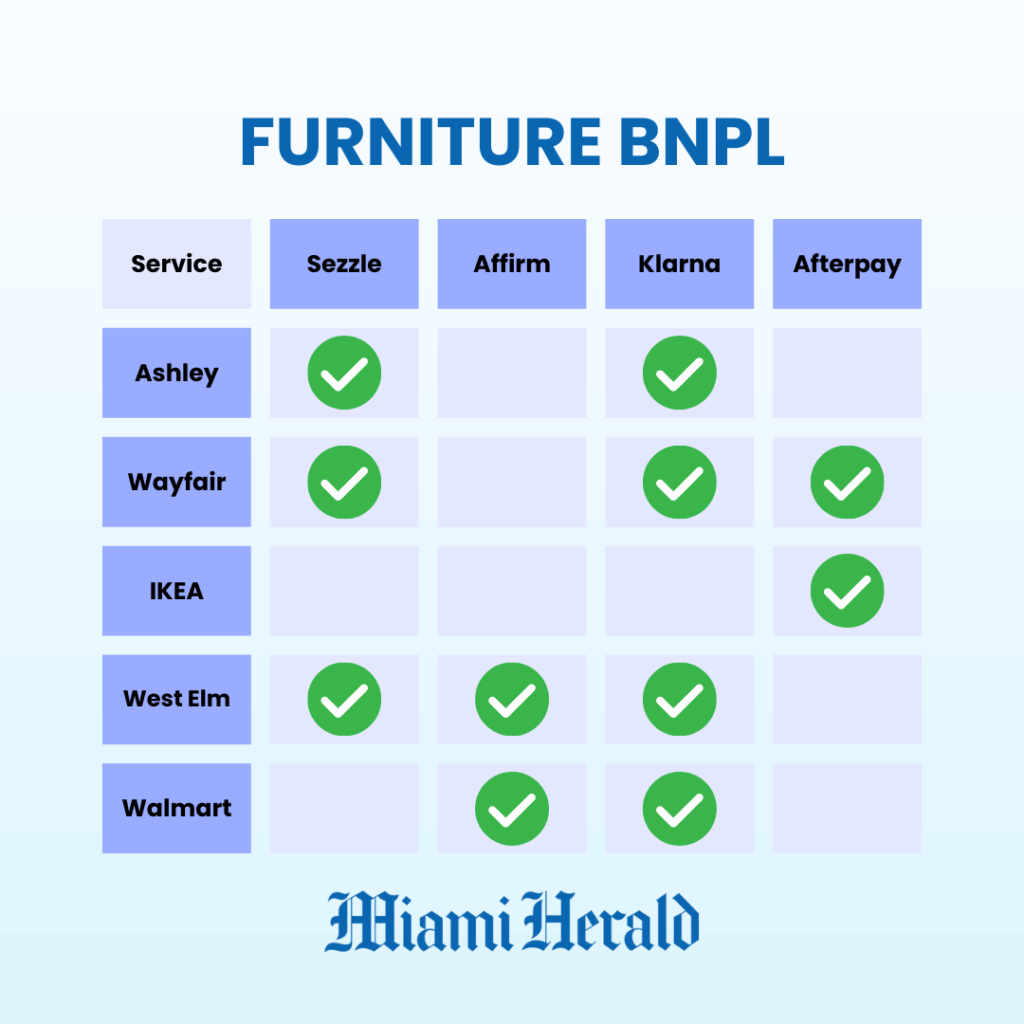

- Ashley Furniture: One of the largest names in the game, Ashley partners with Klarna and Sezzle to offer longer-term plans. You can choose to pay monthly or split into installments, depending on the purchase size.

- Wayfair: Known for its huge selection, Wayfair uses Sezzle, Klarna, and Afterpay at checkout. That means you can split payments into four interest-free installments or opt for monthly financing if you’re dropping more on a sectional.

- IKEA: IKEA partners with Cash App’s Afterpay in many regions, which makes it easy to break down a big cart into four payments. Some locations also offer third-party financing for higher totals.

- West Elm & Pottery Barn: Both are part of the same company, and they team up with services including Sezzle, Affirm, and Klarna to provide longer-term plans. This is helpful if you’re investing in a statement sofa or dining set.

- Walmart: Their furniture section partners with multiple BNPL services like Affirm and Klarna. Walmart also makes it easy to use BNPL in-store, not just online.

And keep in mind, even if they don’t partner with your preferred BNPL, most have a virtual card that you can use anywhere that accepts Visa. For example, when I bought a piece of furniture from a place that didn’t accept Sezzle, it wasn’t a big deal. I just had to create a one-time purchase card and use it during checkout.

BNPL Services and How They Fit Furniture Purchases

Here’s a quick rundown of some of the most popular BNPL players and what they bring to the table:

- Afterpay: Best for smaller items since it’s usually limited to four interest-free payments. Think accent chairs or nightstands.

- Klarna: Offers both pay-in-four and financing plans with interest. Good if you want flexibility between small décor purchases and bigger furniture investments.

- Affirm: The go-to for larger buys. Great for couches, bedroom sets, or anything that might need six to 18 months of fixed monthly payments.

- Zip: Another pay-in-four option that’s available at many mid-range furniture stores.

- Sezzle: Similar to Afterpay, but some stores allow you to stretch beyond four installments. It’s available at select furniture retailers.

The provider matters because they set the terms. What looks like an easy installment plan could turn into a loan with interest if you’re not careful.

Pros

- Breaks down a large purchase amount into manageable pieces.

- Lets you take home what you need today, whether online or in store.

- Interest-free if you stick to the short-term plans.

- Multiple flexible payment options to match your budget.

Cons

- Late fees can add up quickly if you miss a payment.

- Long-term plans may be arranged pursuant to lending agreements, which means interest charges.

- Easy to overspend since you don’t feel the full cost upfront.

What to Watch Out For When Financing Furniture with BNPL

BNPL isn’t a magic solution; it’s a tool. To use it wisely, keep these points in mind:

- Read the Fine Print: Some plans are zero-interest, while others tack on financing costs that can rival credit cards.

- Know the Structure: There’s a big difference between splitting into four payments interest-free and committing to a year-long loan.

- Double-Check Accepted Stores: Not every store allows BNPL in-store, even if they do online.

- Budget First: Just because you can split a purchase into installments doesn’t mean you should.

Final Thoughts

BNPL has made it possible for more people to decorate their homes without emptying their bank accounts. Whether you’re buying a starter couch or upgrading to a full dining room set, there’s probably a plan out there that fits. The key is to know your options, choose the right service, and avoid the traps that come with missed payments or high-interest financing.

If you stay on top of your budget and use BNPL thoughtfully, buying furniture doesn’t have to feel like a financial leap; it can feel like a well-planned step toward making your home your own.

FAQs

You can find BNPL options at Ashley, Wayfair, IKEA, West Elm, Walmart, and other major furniture stores, both online and in-store.

Wayfair partners with Klarna and Affirm. Klarna offers pay-in-four installments, while Affirm lets you spread payments over several months.

Many BNPL providers don’t require a credit check for smaller purchases, so you can split payments with a debit card or bank account.

Store-branded credit cards, like those from Ashley or Rooms To Go, are often easier to qualify for, though terms can vary widely.

It depends on the lender, but traditional financing often requires around 600 or higher. Pay-in-four BNPL services usually don’t have a set score.