Let’s get this out of the way: you’re probably not going to finance a brand-new SUV in four payments with buy now, pay later (BNPL).

When I searched “cars” on Sezzle just to test it out, the only thing that popped up was Lightning McQueen t-shirts. Funny? Yes. Practical? Not so much.

But here’s the surprising part—BNPL does show up in the auto world. While you won’t see someone splitting a $30,000 car into four installments, people are using services like Sezzle and Affirm for things like:

- Covering a down payment on a used car

- Buying auto parts, repairs, and tires

- Financing smaller vehicles like scooters, e-bikes, or motorcycles

For example, I’ve personally used BNPL to buy my daughter new tires. Instead of one big bill at checkout, I spread the cost into smaller payments and still drove home safely. That’s the real strength of BNPL here: making car ownership more manageable when life throws those inevitable expenses your way.

Key Takeaways

- You Won’t BNPL Your Dream SUV: BNPL isn’t built to replace traditional auto loans or leases.

- Sezzle Shines for Smaller Auto Costs: Tires, accessories, or repairs fit well into pay-in-4 plans.

- Some Offer Higher Limits: Some drivers use BNPL loans for used cars or large down payments.

- Auto Parts Retailers Accept BNPL: From tires to electronics, many stores offer pay-later flexibility at checkout.

- Think Ownership Costs, Not Just Cars: BNPL is best for repairs, upkeep, and budget shocks — not for financing a whole vehicle.

So, Can You Actually Buy a Car with BNPL? Real Experiences

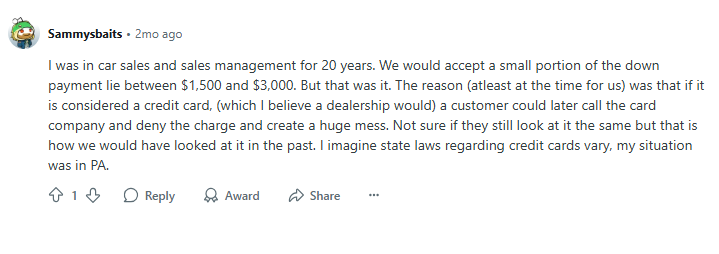

Every so often, people toy with the idea of skipping a traditional auto loan and just using BNPL. One Reddit user with a high Affirm spending limit asked:

“I heard of people using Affirm for a down payment, but could I technically buy a car outright from an auction or dealership?”

The replies tell the story:

- One commenter said their friend tried to buy a $13,000 motorcycle with Affirm:

“The dealer swiped the card multiple times, but Affirm blocked it every time. Later, my buddy bought an $8,000 used car at a small lot and it went through.” - Others pointed out the risk of the high rates:

“Affirm loans can run 25–36% APR. You’d pay way more in interest than with a normal car loan.” - Some suggested it’s technically possible, but unlikely at big dealers:

“Good luck finding a dealership that takes Affirm. Credit cards, sure. But BNPL? Highly doubtful.” - A few even admitted to flipping cars and bikes with BNPL, but warned it’s not for the average buyer.

And while one commenter argued that “Affirm can’t repo your car if you don’t pay,” others were quick to note the tradeoff: your credit can still take a hit, and you lose the benefit of having a car loan reported as positive credit history.

Bottom Line: Yes, some people have managed to use BNPL for used cars under $10,000, usually through smaller lots. But it’s rare, inconsistent, and almost always more expensive than a conventional loan. For most people, BNPL is better reserved for car-related costs like repairs at a garage, car parts on Amazon, or tires, not the entire purchase price.

Save $15 on Your First Amazon Purchase via Sezzle App

Where BNPL Fits into Auto Purchases

You won’t see BNPL replace an auto loan anytime soon, but here’s where it’s actually useful:

- Auto Repairs & Tires – Flat tire? Brake pads? Oil changes? BNPL helps cover surprise expenses.

- Down Payments – Some buyers use Affirm for a big initial payment on a car loan.

- Accessories & Upgrades – Think rims, sound systems, or car electronics.

- Smaller Vehicles – Scooters, e-bikes, and even motorcycles sometimes qualify for BNPL checkout.

How BNPL Payments Work for Cars

Since cars vary wildly in price, here’s what real BNPL plans look like across common auto scenarios:

$400 Tire Replacement

| Plan Type | Payment Example | Total Cost | Notes |

|---|---|---|---|

| Pay-in-4 (Sezzle) | $100 every 2 weeks | $400 | No interest if paid on time |

| 6-Month Plan (General BNPL, ~19% APR) | ~$70/month | ~$420 | Interest may apply |

| 12-Month Plan (Affirm, 15% APR) | ~$36/month | ~$432 | Adds ~$32 interest |

$1,200 Down Payment on a Used Car

| Plan Type | Payment Example | Total Cost | Notes |

|---|---|---|---|

| Pay-in-4 (Sezzle) | $300 every 2 weeks | $1,200 | Useful if retailer allows |

| 6-Month Plan (General BNPL, ~19% APR) | ~$210/month | ~$1,260 | Not always interest-free |

| 12-Month Plan (Affirm, 15% APR) | ~$108/month | ~$1,296 | Adds ~$96 interest |

Hidden Costs to Watch

BNPL for cars may sound appealing, but there are pitfalls:

- Late Fees: Miss a payment, and you could owe more.

- Interest Creep: Longer-term BNPL plans (like Affirm loans) add up quickly.

- Eligibility Limits: High spending power isn’t available to everyone.

- Refund Headaches: If a part is returned or a repair is canceled, sorting out the BNPL balance can be tricky.

Final Thoughts

You probably won’t use BNPL to drive a new car off the lot — but you might use it to keep the one you already own running smoothly. From tires and repairs to down payments on used cars, services like Sezzle and Affirm give drivers more flexible payment options when budgets get tight.

Just remember: BNPL for cars works best as a tool for smaller auto costs or short-term financing, not a substitute for a traditional car loan. Used responsibly, it can take the sting out of surprise bills and make car ownership a little easier to manage.

FAQs

Not usually. BNPL works better for down payments or smaller auto-related costs like tires and repairs.

Not full cars — but Sezzle is widely used for auto parts, accessories, and repair costs where Pay-in-4 makes sense.

Yes, in some cases. Affirm offers higher limits that can apply to used vehicles or down payments, but interest rates vary, and this could quickly balloon into an unaffordable payment.

Not always. While Pay-in-4 plans may be interest-free, longer BNPL loans often carry APRs that make them more expensive than traditional financing.

Stick to smaller expenses like tires, repairs, and accessories. For full vehicle purchases, compare traditional loans and financing options before committing.